Getting a mortgage is essential for most would-be homebuyers. Unfortunately, our country has a legacy of keeping homeownership out of reach for people of color.

That's why the Home Mortgage Disclosure Act keeps track of who's getting approved for mortgages, including their race and ethnicity.

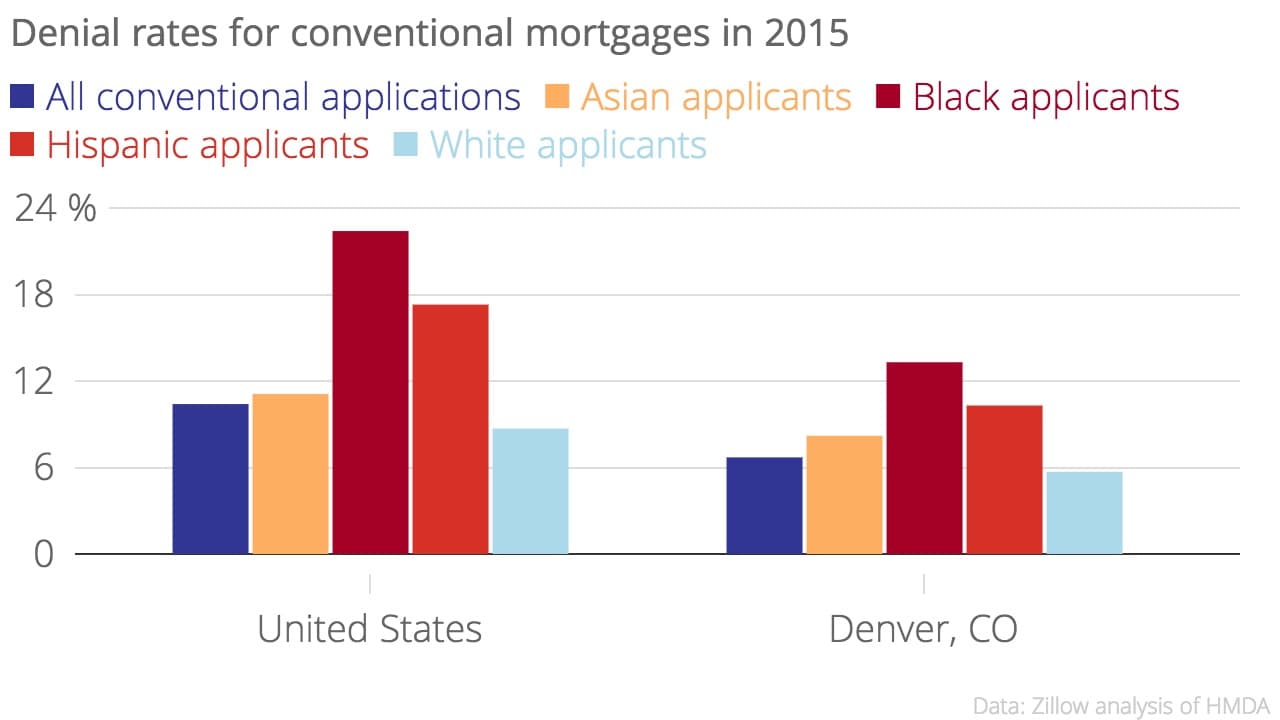

Data from 2015 analyzed by Zillow shows that in Denver, some people are still more likely to be denied than others.

Though Denver has a lower-than average denial rate overall, 6.7 percent, there still big gaps among minority applicant denial rates and white applicant denial rates.

The biggest of these is the gap between white applicant denials and black applicant denials, with nearly 7.6 percent between them. Nationally though, the gap is even bigger -- 13.7 percent.

There are many reasons that a mortgage may be denied, but low rates of homeownership in Hispanic community has meant missed opportunities to build wealth.