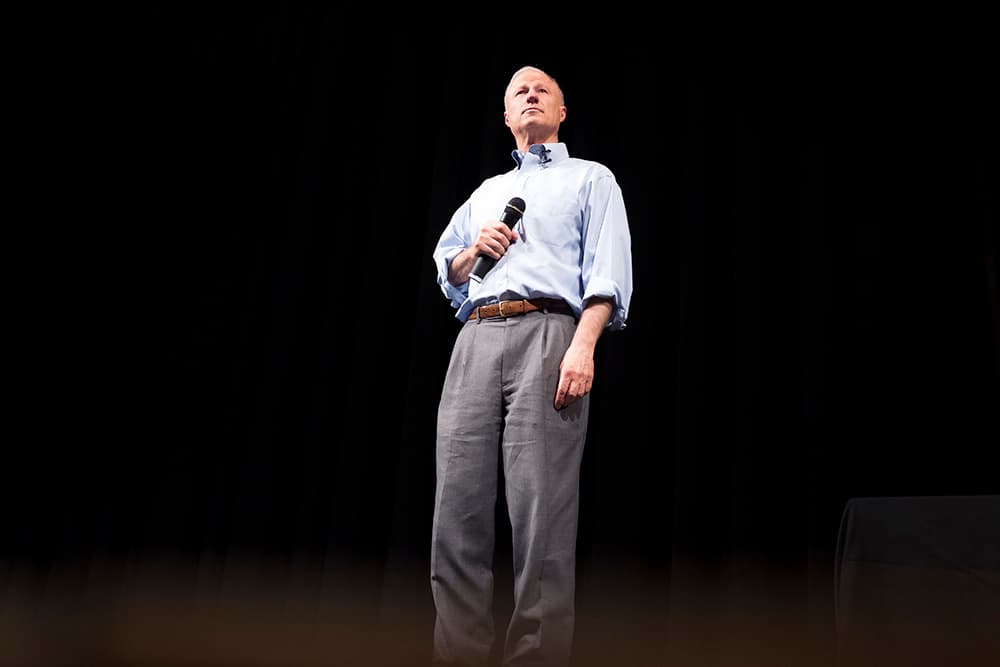

U.S. Rep. Mike Coffman thinks the tax bill approved by Congress this week will spur growth in the economy, pay for itself over time and provide the necessary impetus to pass changes in health care laws.

That's why the Aurora Republican was not just comfortable but proud to vote for a tax bill that the Congressional Budget Office said would increase the federal deficit by $1.4 trillion over 10 years.

"Doubling the standard deduction is going to have a really positively impact," he said. "It will mean the vast majority of Americans will no longer have to itemize. Doubling the child tax credit from $1,000 to $2,000 is going to be a big plus for families. We're lowering rates across the board. And it does something that's never been done before, which is lower the tax rate for small businesses which are not corporations."

In Coffman's opinion and the stated opinion of many Republican backers of the bill, these measures, along with lowering the corporate tax rate to 21 percent from 35 percent, will increase growth in the economy and increase tax revenue to the federal government.

The corporate tax cuts are permanent, but the tax cuts for individuals expire in 2025, at which point many people will see their taxes increase.

The tax bill passed in a very partisan fashion. Twelve Republicans in the House voted no, but not a single Democrat voted for it. The Republican no votes mostly come from high-tax states where people will be hit by a provision that caps how much of state and local taxes you can deduct from your federal taxes. Colorado, in contrast, is a relatively low-tax state -- though in a surprise twist, it turns out the federal tax bill could cause people to pay more in state taxes.

In an interview, Coffman said he believes the tax bill will more than pay for itself. He called much of the criticism of the bill "misinformation."

"This bill is very important for the economy and very important for Republicans," he said. "I'm obviously disappointed that it fell along partisan lines."

Democrats, on the other hand, believe the tax bill was deliberately structured to create a shortfall to justify cuts to social programs.

“This Republican tax bill gives the most benefits to corporations and the wealthiest Americans, plain and simple," Rep. Ed Perlmutter, an Arvada Democrat, said in a press release. "These benefits are paid for by hardworking families across the country and by adding to the debt. This bill may save a few hundred dollars per person on their tax bill, but it will put more than $7,100 on the credit card for every man, woman and child in the U.S. which will lead to deep spending cuts on important programs like Medicare and Medicaid and jeopardize investments in infrastructure, education, healthcare, science and much more."

Many economists are skeptical the broader economy will reap the benefits predicted by Republicans.

The University of Chicago's Initiative on Global Markets surveyed 38 academic economists, and 37 said the tax bill would cause government debt to grow at a faster pace than the overall economy. (The 38th later said he misunderstood the question and agreed with his colleagues.) And in the same survey, only one economist said the tax bill would help the economy. A plurality said it wouldn't help the economy, and rest weren't sure what the impact would be.

USA Today describes some of the complications: Many companies are already experiencing high profits, but they haven't necessarily invested in new equipment or expanded production. That's because the market has to be there to support those investments, and in many industries that isn't the case. Many large companies have said they will use their tax windfall to increase dividends to shareholders or to buy back stock, though AT&T said it would give a bonus to workers.

If the deficit grows, that could raise interest rates. On the other hand, if the economy grows at a faster pace, that could spur the additional investment that backers of the bill hope to see.

The right-leaning Tax Foundation made a rosier forecast, but even its economists said the bill will not fulfill Republican promises. The Tax Foundation analysis predicts the bill will grow the economy by 1.7 percent and add $488 billion to the federal deficit, roughly a third what the Congressional Budget Office predicted.

In the New York Times, Douglas Holtz-Eakin, a former director of the Congressional Budget Office and the president of the conservative American Action Forum, and Kimberly Clausing, an economist and tax expert who teaches at Reed College, debated the potential impact of the bill. That's worth a read.

The tax bill will have some surprising effects in Colorado.

State economists are predicting that Colorado will take in an additional $196 million to $300 million in state taxes due to changes in the tax code. As The Denver Post's Brian Eason explains, state income tax is 4.63 percent of federal taxable income. The tax bill gets rid of a lot of deductions, though, so many people's taxable income will be higher. They might pay less in federal taxes in the short-term because rates are going down, but the state tax rate stays the same. How individual taxpayers are affected will depend on how many deductions they take now and whether those deductions remain under the new tax bill. And the federal tax cuts expire in 2025, so many people's federal taxes would go up at that point too.

In the meantime, state lawmakers are calling for the extra money to go to transportation.

The tax bill also repeals a key piece of the Affordable Care Act: the individual mandate.

Starting in 2019, people who don't have health insurance won't have to pay a tax penalty. The individual mandate that every person have insurance was the cornerstone on which Obamacare was built, and it's how the federal government justified forcing insurance companies to cover everyone, regardless of pre-existing conditions.

President Donald Trump called this the "repeal" of Obamacare that Republicans in Congress couldn't achieve earlier this year. It's not -- the health care exchanges still exist and insurance companies still have to cover everyone -- but this has the potential to introduce a lot of instability into insurance markets and drive premiums even higher.

Coffman, though, thinks this will provide the impetus for bipartisan health care reform. With the individual mandate expiring in a year, Congress will have to do something, he said.

"It's deferred to give us time to find some substantive policies to stabilize the individual market," said Coffman, who is a member of the Problem Solvers Caucus.

Coffman ultimately voted against the Republican health care reform bill, saying it left some people with pre-existing conditions vulnerable. But while many Republicans seem plenty happy to leave their beleaguered repeal efforts in the past, Coffman has been insistent that Congress needs to do something. This week he said he was "very optimistic."

"Just like on DACA, (the deadline) puts pressure on us to find an agreement," Coffman said. "Otherwise, people would be looking away. It gives us a year to come up with a solution."