Denver voters will have up to nine chances to change how the city works during this November's elections.

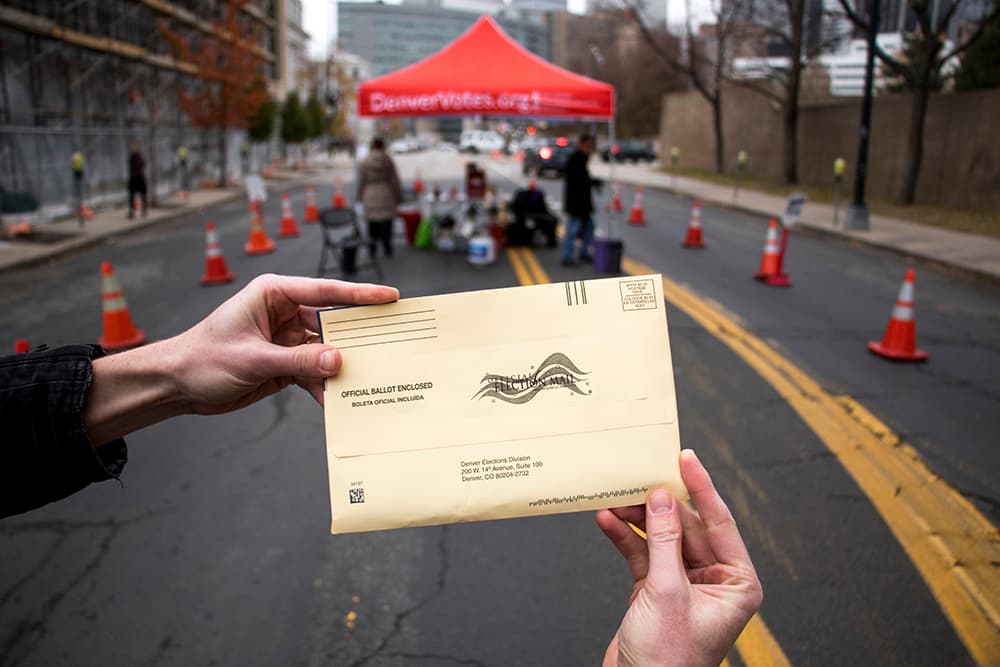

And in case you haven't heard, this fall's ballot will be the longest in the city's history. Ballots will be drop starting Oct. 15, so many of you could start seeing your ballots in the mail that same week.

Keep reading to see what's on deck for this year, and refer to our previous coverage for a list of statewide ballot initiatives (they will also be on your ballot). There are quite a few potential tax increases, plus some other interesting changes. The city has also created a TABOR blue book that provides more information on the fiscal impact of some of the city's ballot measures.

Here's a breakdown on what you'll see in November (check out a sample ballot here to familiarize yourself):

Side 1: Candidates for offices, including state and federal offices.

Side 2 to 4: The 13 statewide ballot initiatives.

Side 4 to 6: The nine City and County ballot initiatives.

A quick primer on ballot initiatives:

Colorado's elections ballots can come with long lists of scary-looking questions. If enough voters agree with the initiatives, they can change state and city laws.

These questions can land on the Denver ballot in two ways: Groups can collect thousands of signatures from voters (initiated ordinances), or the Denver City Council can decide to do it themselves (referred measure).

This is quite different from the usual way that laws get made, and it can result in radical new ideas, such as the city's new green roofs requirement, or the state's legalization of marijuana.

The Denver City Council does have some power to revise the laws, even after they're approved by voters. They're doing that now with the green roofs requirement. They also have repealed some voter-approved laws altogether.

And, since these measures deal with taxes, here's what to know:

- Denver's city sales tax is currently 3.65 percent. Combined with other taxes, you currently pay 7.65 percent tax on most goods and services here.

- The city's sales tax on retail marijuana is 7.15 percent. Combined with other taxes, you currently pay 23.25 percent on weed here.

These proposals are set for the ballot.

Increase sales taxes to pay for parks.

Referred Measure 2A: A measure backed by Council President Jolon Clark would add 0.25 percent to the cost of many goods and services, or about 25 cents on a $100 purchase. It would generate $46 million for parks construction and maintenance in 2019.

To learn more: Want some new parks? Denver will vote on $46 million of new taxes for green space. (Denverite)

Change the rules about changing the rules.

Referred Measure 2B: The Denver City Council has approved a ballot initiative that would change the rules for collecting signatures for these types of ballot initiatives. It would make it harder in some years, but easier in others, to place a question on the ballot.

To learn more: Denver voters will decide in November whether to change the rules about changing the rules. (Denverite)

Police Department hires

Referred Measure 2C: This ballot question asks whether the city's charter should be changed to allow more flexibility in hiring police officers from other jurisdictions.

During a City Council committee meeting on June 27, Earl Peterson of the Civil Service Commission said they want to attract more lateral police recruits and make the city more competitive. Peterson said the department's standard for recruiting cops from other departments are currently restrictive.

A measure to change the structure of the Clerk and Recorder's Office.

Referred Measure 2D: If approved by voters, it would allow the position of director of elections to change from an "appointed" position to a regular city employee. It also would allow the clerk to appoint two additional positions of his or her choice.

Make millions available for public financing of campaigns and create new limits on donations to politicians.

Referred Measure 2E: The Democracy for the People Initiative has made the ballot as a referred measure. It would dramatically lower the limits on how much money a person can give to local candidates. It also would make public funding available for campaigns that agree to additional rules and limits.

Basically, candidates could get $9 from the city for every dollar they raise for Denver residents, up to hundreds of thousands of dollars.

To learn more: Campaign financing in Denver could look different come 2020 — it’s up to voters now. (Denverite)

Increase sales taxes to provide Colorado scholarships.

Initiated Ordinance 300: The Denver College Affordability Fund measure is officially approved for the ballot. It would raise at least $13.9 million by charging an extra 0.08 percent in sales tax, or about 8 cents on a $100 purchase. That should work out to $14 million-plus yearly.

The money would be used to create post-secondary scholarships for Denver residents. It would be available for people younger than 25 who have lived in Denver for at least three years. The scholarships can be used at "regionally accredited nonprofit or public" schools in Colorado, and only for students in good standing. The money would be doled out by nonprofits based on financial need. "Thousands of students across Denver will be served," wrote campaign manager Roger Sherman in an email to Denverite.

To learn more: Denver chamber leads sales tax hike for local scholarships. (Colorado Politics)

Raise the sales tax to fund housing and health services.

Initiated Ordinance 301: Caring 4 Denver submitted more than 10,000 signatures on Aug. 2, and it was approved for the ballot on Aug. 21. The measure would charge you an extra 0.25 percent on purchases, or about 25 cents on $100. It would initially generate $45 million per year.

The campaign is spearheaded by Rep. Leslie Herod with support from Mental Health center of Denver. The money would be spent on suicide prevention; mental health services, opioid and substance abuse services; and affordable housing with services to reduce homelessness, incarceration and hospitalization.

To learn more: Denver tax proposal would raise $45 million per year for mental health, housing, addiction. (Denverite)

Initiated Ordinance 301 — Caring 4 Denver — aims to relieve a mental health system under duress. (Denverite)

A sales tax to promote healthy eating.

Initiated Ordinance 302: The Healthy Food for Denver's Kids initiative would charge an extra 0.08 percent in sales and use tax on purchases -- again, that's 8 cents per $100. The money would go toward groups "whose primary purpose is to provide healthy meals and healthy snacks" for people under 18.

A chief organizer is Blake Angelo, the city's former manager of food system development.

To learn more: A tax proposal funding food education programs for Denver kids is on the city’s ballot. (Denverite)

Urban Drainage and Flood Control District.

Ballot Issue 7G: This ballot initiative is a tax increase for the Urban Drainage and Flood Control District, which provides several cities and counties in the metro area with flood control. According to the Denver Post, this ballot question will ask voters to restore its taxing authority to generate $14.9 million. This money would be used to maintain early flood warning gauges, help with land preservation for trails and wildlife habitats, and help remove debris and garbage from streams, creeks and rivers.

The reason this ballot question has a different title than all the others is because it's a multi-county initiative, meaning that in addition to Denver, other metro area counties will see their questions on their ballot since it also affects them.

To learn more: Little-known flood-control district asks Denver metro voters for first tax hike. (Denver Post)

Need more?

You're insatiable. You can find the documents for each initiative on the Denver Elections website. The language of each initiative is available under the "approved title language" column of the spreadsheet. OR! Ask us questions by using the form below:

Updated throughout. Denverite reporters Andrew Kenney and Esteban L. Hernandez contributed to this story.