Updated at 1:05 p.m. on Thursday, Feb. 27, 2025

A proposal to cut wages for some restaurant employees is dividing Colorado Democrats and the restaurant industry.

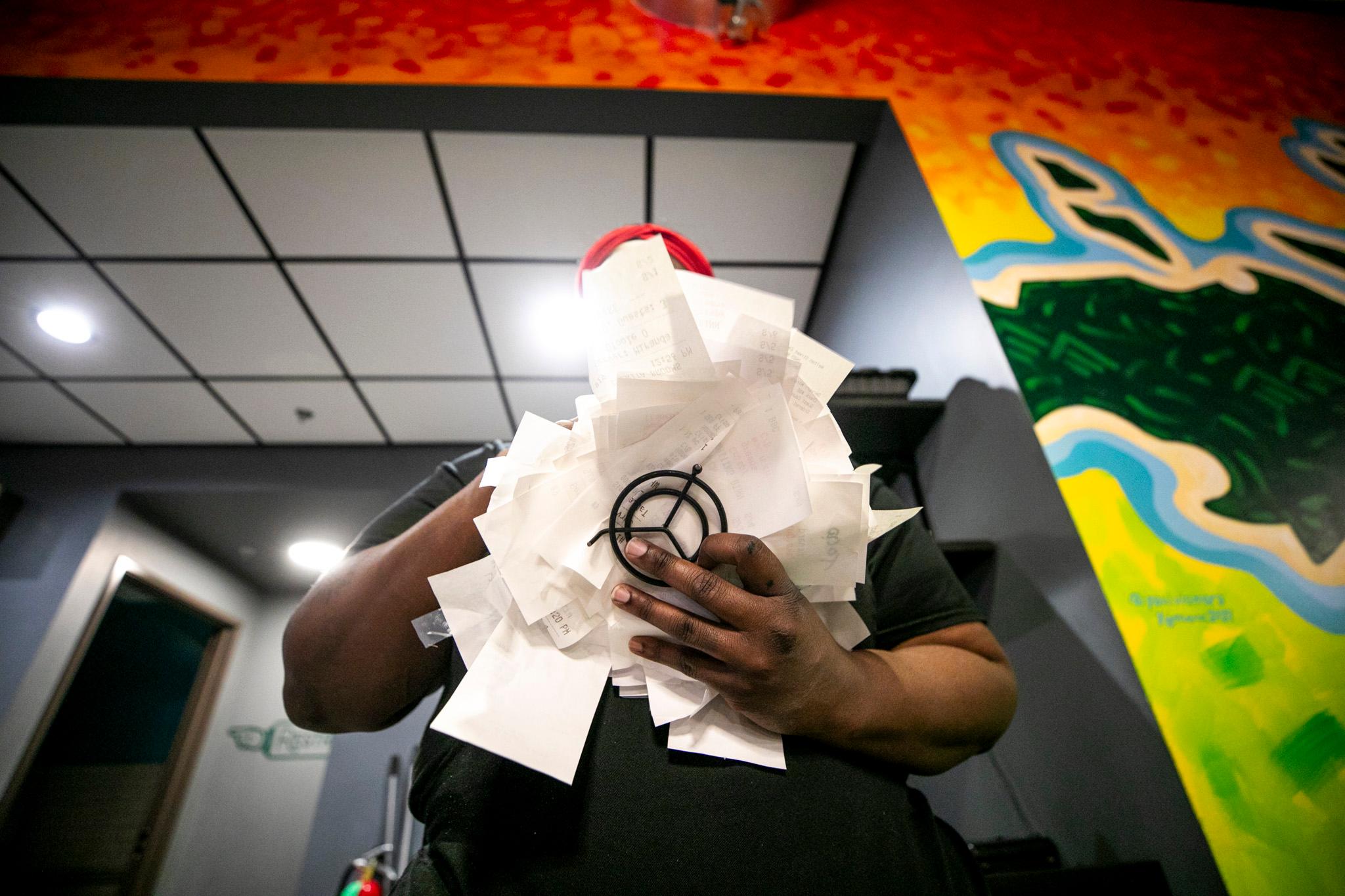

Many restaurant owners say that high labor costs are driving restaurants out of business, and they need a fix to what they say is a flawed law. Meanwhile, many workers and their allies say that HB25-1208 is going to punish hard-working restaurant workers who already can scarcely afford life in the city.

At the heart of it all: the rules for how servers and other tipped employees are paid. Here’s what you need to know.

What is Colorado’s tipped minimum wage?

Like most states, Colorado has a special set of rules for how tipped employees like servers and bartenders are paid.

Business owners have to pay wages to employees who get tips — just like they do for any employee. But the hourly pay from the business to those servers, bartenders and others can be lower than the regular minimum wage.

This concept is most often called the “tipped minimum wage,” although you’ll also hear people referring to a tip credit or tip offset. In Denver, the tipped minimum wage is $15.79 an hour. The employee gets at least that amount directly from the employer for every hour worked.

There’s one more caveat: Sometimes, if tips are low, the employer must pay a higher base wage to tipped employees. The employer must guarantee that, when combining base wages and tips, every employee is making the actual minimum wage of $18.81 an hour.

So, in short:

- If employees are getting at least a few dollars an hour in tips, the employer can pay the tipped minimum wage of $15.79

- If employees are not getting enough in tips, the employer will have to kick in a higher base wage, ensuring tips and wages combine to hit $18.81 total

How would HB-1208 change the tipped minimum wage in Colorado?

Currently, the tipped minimum wage is exactly $3.02 less than the minimum wage. A few Colorado cities have set their own, higher minimum wages — which results in local restaurants paying higher tipped minimum wages, too.

The proposed state law would flatten out the tipped minimum, resetting it to the same level for all cities in Colorado. It would not affect the regular minimum wage.

| Area | Minimum wage for 2025 | Tipped minimum wage for 2025 | Proposed tipped minimum wage for 2025 | Proposed change in tipped minimum or 2025 |

| Denver | $18.81 | $15.79 | $11.79 | $4 |

| Edgewater | $16.52 | $13.50 | $11.79 | $1.71 |

| Boulder unincorporated | $16.57 | $13.55 | $11.79 | $1.76 |

| Boulder | $15.57 | $12.55 | $11.79 | $0.76 |

| Rest of Colorado | $14.81 | $11.79 | $11.79 | $0 |

The change would affect an estimated 21,000 employees in Denver and Boulder counties, according to state legislative analysts, plus more in Edgewater.

The new statewide tipped wage would take effect on Sept. 1, 2025. But it would not stay at $11.79 permanently. It would raise annually with the state’s regular minimum wage, which is adjusted for inflation.

And starting on Oct. 1, 2026, cities would get some more flexibility to change their own tipped minimum wages. They could start adding up to $0.50 to the tipped minimum each year, in addition to inflation-driven increases, if local lawmakers chose to do so.

All this would have the greatest effect in Denver, where tipped workers would lose up to $4 for every hour of work, compared to current laws.

What’s the argument?

Denver has some of the highest wages for tipped employees in the country. (More on that later.)

Some restaurant owners argue that they’re being forced to pay too much money to workers who are already doing well with tips. Cody Higginbottom, founder of Public Offering Brewing, said at a committee hearing that his front-of-house staff were significantly out-earning management and ownership.

“I want to pay our employees as much as possible and provide a livable income, but I also think there should be a fair and equitable pay structure,” he said.

Higginbottom and others argued that pay to servers was getting in the way of more money for dishwashers and others.

“Denver meant well, but the system is out of balance, and the fate of hundreds of independent restaurants and our thousands of employees are at stake,” said Delores Tronco, owner of The Greenwich in Denver.

But many restaurant workers and their supporters are pushing back, arguing workers are already struggling to get by.

“Why aren't they looking for solutions to reduce the rising cost of goods? Why aren't they working with restaurant owners to craft bills that provide tax relief,” said Sid Farber, a founder and worker-owner at Moonshell Pizza Cooperative. “Democrats wonder why workers aren't voting for them, this is why.”

As of Feb. 26, HB25-1208 had cleared its first committee hearing. It is heading next to the House Finance Committee. It would next go to the full House and then to the Senate.

What would the impact on workers and employers be?

A legislative analysis found the state would lose about $6.8 million in income taxes — with an estimated total loss of $151.4 million, based on 2024 data, according to principal economist Louis Pino.

Pino estimated the average affected employee could lose between $7,000 and $7,500 per year in wages.

The largest impacts would be in Boulder and Denver counties, which make up most of the population of workers that would be affected.

Denver Auditor Tim O’Brien sent a letter to bill sponsors on Feb. 7 saying he was deeply concerned about how the reduction in wages would impact workers. His own analysis, based on numbers from the Bureau of Labor Statistics, showed the bill would reduce the average weekly earnings of tipped employees by $160. (That appears to assume a loss of $4 an hour for someone working 40 hours a week.)

“This is money these people need for food, rent, utilities, transportation, daycare, doctor’s visits, diapers, formula, and all the other necessities of modern life,” O’Brien wrote.

In contrast, Juan Padró, owner of Culinary Creative Group, argued that Denver restaurants have cut staff to deal with rising wages.

“You can’t just keep raising prices and pricing people out of your restaurant,” Padró, said in an interview with Denverite. “Every dollar increase in the tipped minimum wage that we have faced in the last five years has wiped out about $50,000 a year in profit [for individual restaurants within the company].”

How have minimum wages changed in Colorado?

Over the last few years, high inflation rates nationally have led to faster growth in the state and local minimum wages.

Some restaurant owners say that growth is exposing a flaw in the way the tipped minimum wage is set. It’s calculated by subtracting a fixed amount, $3.02, from the minimum wage. That number is set in the state Constitution and hasn’t changed in many years.

The result is that the tipped minimum wage makes up a larger and larger portion of the regular minimum wage. Back in 2005, the state’s tipped minimum wage was just $2.13, making up less than half the minimum wage at the time.

Today, the tipped minimum wage statewide is 77 percent of the regular minimum wage.

The effect is more pronounced in cities with higher minimum wages. In Denver, the tipped minimum is 84 percent of the regular minimum.

The bill would drop the tipped minimum wage in Denver to roughly the same level it was in 2021.

How do other places handle it?

With $15.59 an hour in base wages, Denver’s tipped employees are near the top of the scale nationally.

In California and Washington, tipped employees get at least $16 an hour in wages. That's because in those states and several others, there is no special tipped minimum wage — all employees get the regular minimum wage. Advocates like the Economic Policy Institute argue this is a better approach, since paying lower wages to tipped employees only reinforces the issues with tipping.

Other states and cities take a variety of approaches to the tipped minimum wage. A few cities and states have rates similar to what’s being proposed for Denver:

- In New York City, the minimum wage is $16.50 an hour, while tipped food service workers getat least $11 an hour.

- In Washington, D.C., the regular wage is $17.50, while tipped workers get at least $10.

- In Arizona, the regular minimum wage is $14.35, while tipped workers get at least $11.35.

Most states, like Colorado, determine the tipped minimum wage by subtracting a set number from the minimum wage. But a handful use a percentage-based formula. For example, tipped employees get 50 percent of the minimum wage in Missouri and Maine. In North Dakota, it’s always 33 percent.

In Massachusetts, voters recently rejected a proposal to end tipped minimum wages.

Under federal law, the lowest allowable minimum wage for any state to enact is $7.25 an hour, with a tipped minimum of $2.13.

How have minimum wage laws changed in Colorado?

Colorado has made a series of important changes to minimum wage laws over the years.

Back in 2006, voters raised the state minimum wage above the federal rate, and they agreed that the minimum wage should rise each year with inflation. In 2016, voters set the Colorado minimum on a faster growth path for several years.

In 2019, state lawmakers allowed local governments to start setting their own minimum wages, with some limits. Denver, Boulder, Boulder County and Edgewater have done so.

Questions? Comments? Personal experiences? Let us know.

Editor's note: This article was updated with additional information from Louis Pino's analysis.