Your offer on the house of your dreams has been accepted. You even got it inspected, so it's time to get smug and start throwing words like "equity" around.

Not quite. Turns out the most mundane-sounding part of the process has become quite a headache.

Welcome to the wild world of real estate appraisals.

First, appraisals establish the value of a property. For the average Joe, it's necessary for starting a loan or refinancing a mortgage. So if you can't get one, it'll cause some problems.

... Like if you already sold your home and placed an otherwise successful offer on new home. Then you're stuck trying to convince someone to let you stay in the home you intend to buy, but haven't.

Michelle Ackerman, who heads the Denver market for Redfin, says that's already happened. And if the seller is also buying a home, they may be delayed too. Ackerman says this cascading effect can affect as many as three or four other people.

"We are seeing appraisals take as long as 7 to 8 weeks, which is about double what it took earlier this year," she said.

You can get an appraisal done quicker if you're willing to pay a much greater amount. One alternative is to use a local lender -- Ackerman says they are sometimes quicker because they are more in touch with the market.

Appraiser Brent Henry, SRA, says he's so busy that he probably doesn't even read three-quarters of the offers that come in.

"A lot of times the bank will say just tell us your fee because they have to get it done," he said. "I'm seeing rush fees of $1,000 too – I'm not saying it's common, but they do offer it just because there's so much on the line."

The problem

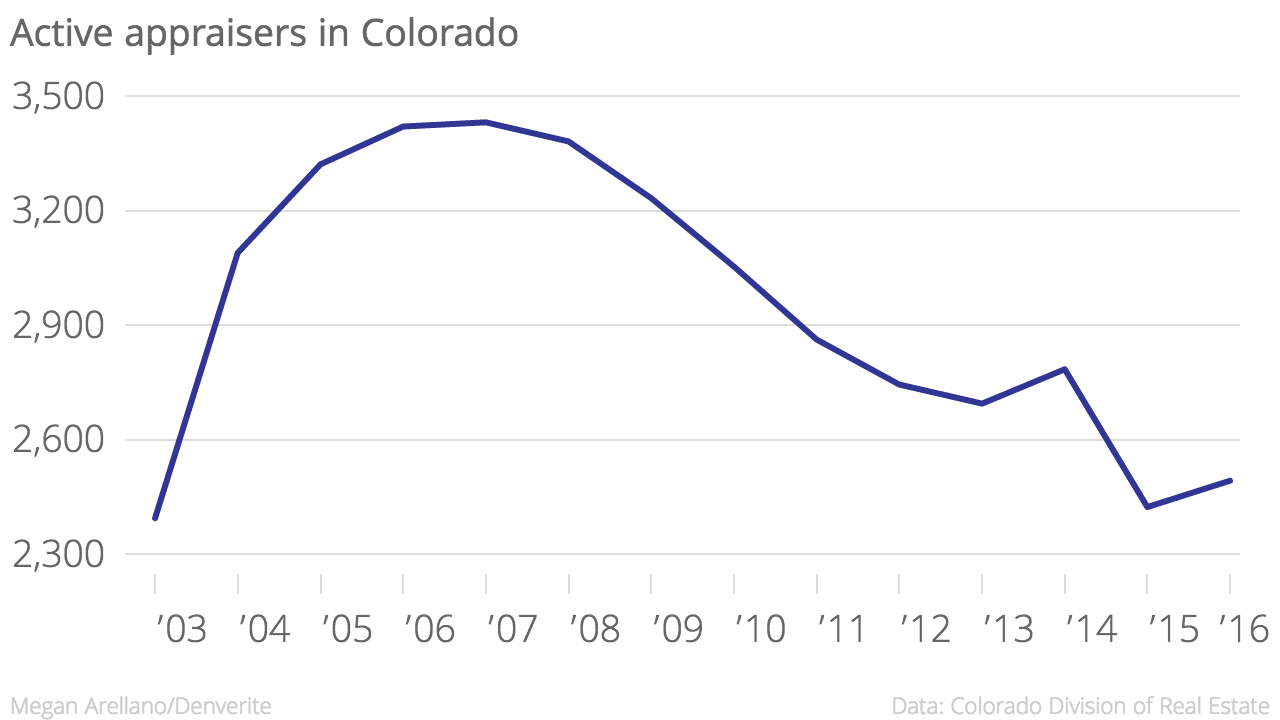

The long wait time for an appraisal isn't just about the hot real estate market. There's also just fewer appraisers to do the job.

"Each renewal cycle, we see attrition of the appraisers dropping off and not renewing," said Marcia Waters, director of the Colorado Division of Real Estate. "In one year during the renewal cycle, we lose 15 to 25 percent of our renewing population."

Part of that is because Colorado's appraisers are getting older; the average age of a Colorado appraiser is 54.1 years old.

With rush fees of $1,000 or more, you'd expect that more people would be interested in becoming appraisers. But federal appraiser licensing requirements changed in January 2015 to require a college degree and more education, making it tougher. Plus, would-be appraisers have to spend 2,500 hours training in the field over at least two years.

"Every inspection, the main appraiser has to inspect the property, so you can't really send a trainee to do anything," Appraiser Brent Henry said. "I spend more time on a deal if I'm doing it with a trainee than if I did it myself. So I'm losing money with a trainee."

Plus low mortgage rates mean even more people want to refinance their homes, says Waters.

Appraisers from out of state and more trying to fill the void

Henry says he's already helped out another appraiser who came here from California. But it's not a perfect solution for antsy homeowners.

"The problem now is that we have appraisers now who aren't 'geographically competent'. So we're getting appraisers who might be good appraisers, but they don't know the market here so they jump full barrel in," Henry said.

He's also seeing commercial appraisers doing residential work, which can be a problem if they have never been trained to do residential work.

"I'm seeing some reviews of these commercial appraisers and they are doing things that are barely acceptable," he said.

But when the fees for residential work are the same as doing a small office building, it's easier to understand the temptation.

For now, there's not much expectation of relief.