Denver residential property has gotten almost 26 percent more valuable since 2015, according to the latest numbers from the Denver Department of Finance.

Every two years, Denver and counties across the state are required to assess property values based on sales. This time, Denver's median projected value increase was 25.9 percent from 2015 for single family homes, row-homes and condos.

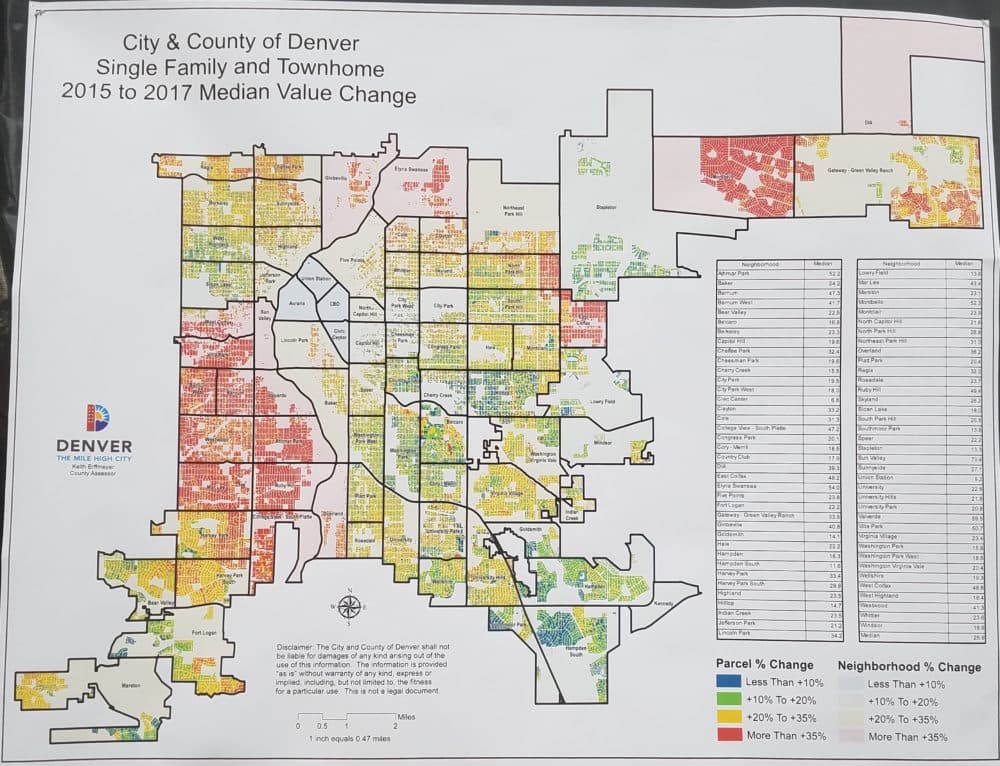

Of course, within Denver there is considerable variability -- namely that neighborhoods with higher valued homes saw a much lower percentage increase other neighborhoods.

"Neighborhoods that saw lower property values in 2015 are seeing the largest percentage increases in Denver now," said Assessor Keith Erffmeyer, "though each neighborhood in Denver has seen growth."

In fact, it seems that the interest of the more affluent homebuyer has finally shifted west of I-25.

The single biggest increase in single family and townhome values, 70.4 percent, happened in Sun Valley, though it should be noted that owner-occupied homes make up only 4.2 percent of the houses there. Just to the south of Sun Valley, Valverde had the second biggest increase with a jump of nearly 60 percent.

For homeowners concerned about a jump in property taxes: Yes, increased values likely mean a higher tax bill. However, the city is expecting that state legislators will lower the residential assessment rate, which will offset some of these increases.

So, put another way, at least one of the elements in the formula that determines property tax is expected to decrease. The city expects that the change in the state assessment rate will lower tax bills back down by 9.5 percent after you factor in the increased values. (That formula, by the way, is value multiplied by assessment rate multiplied by mill rate.)

This home value snapshot is not perfect -- for one, it measures sales from July 1, 2015 to June 30, 2016, so the last six months aren't reflected in this period. Or, other times, it may just not feel accurate to an individual homeowner.

Accordingly, property valuation notices will be mailed to property owners by May 1. If a property owner does not agree with their valuation or classification, they need to mail their protest no later than June 1.