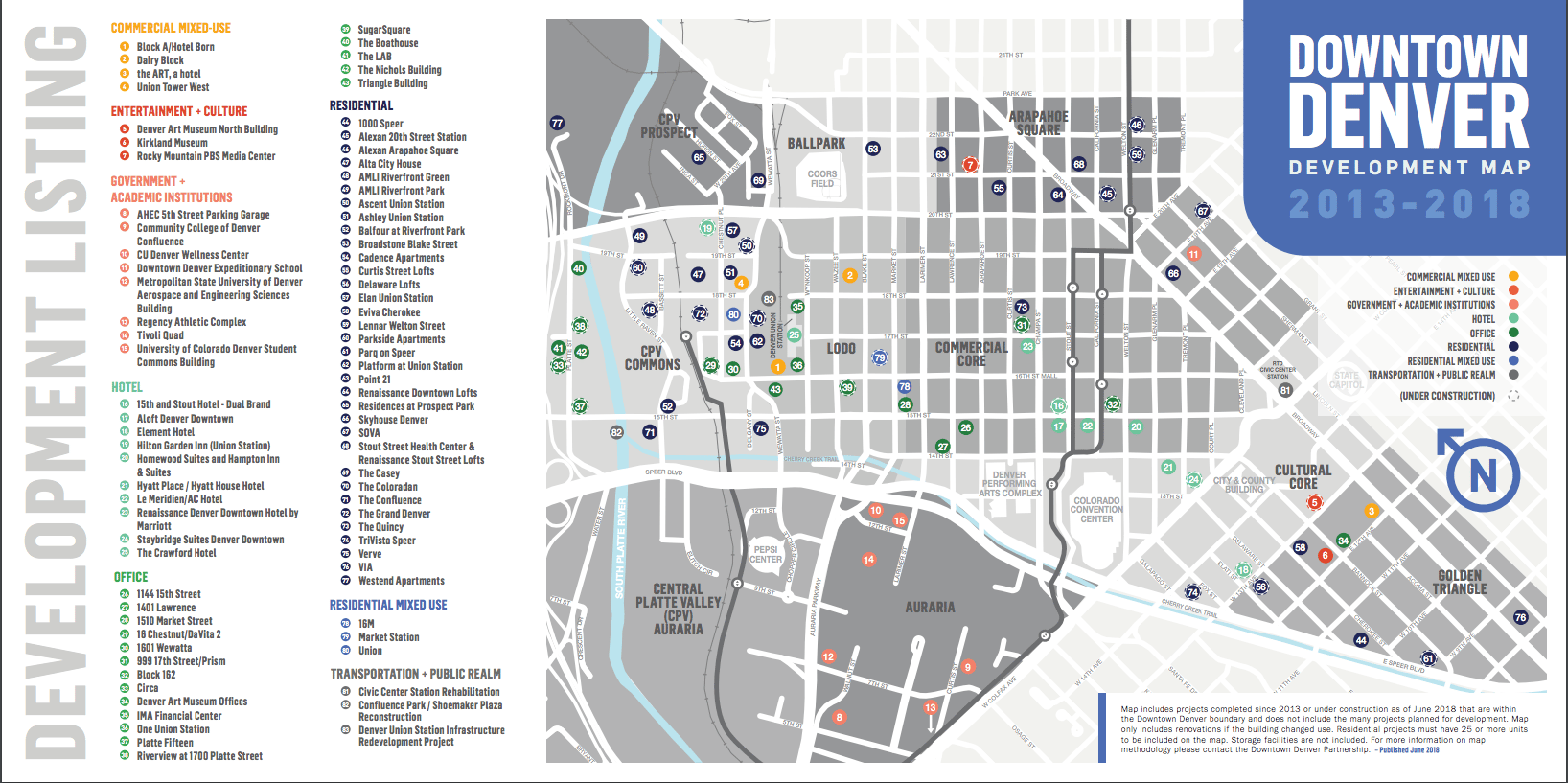

Earlier today the Downtown Denver Partnership hosted an event answering the question, “Where are the cranes going next?”

The short answer is everywhere — literally every part of downtown will continue to see growth.

“In total, 83 projects have been completed over the past five years or are currently under construction, bringing over $5 billion in investment throughout downtown” said Randy Thellen, Vice President of economic development for the Partnership.

And the rest of the speakers reiterated that we should get used to that type of growth. The event featured several different speakers who were able to look at Denver’s potential growth from different perspectives, like where we're building for the workforce and where families will live.

Denver has a new, "healthier" balance of industries.

According to Kevin J. McCabe, the executive vice president of Newmark Grubb Knight Frank, Denver has over the last ten years seen a significant shift in its major industries and the cranes for building office space will follow that trend. He said that during the 20008-10 development cycle, the industry sectors that dominated the economy were typical of the Denver market: energy, law and financial services. From 2013 up until now, however, we have developed a new industrial big three: healthcare, tech, and real estate.

He described our new balance of industries as being significantly "healthier" than our previous setup, which could make us more immune to the consequences of an economic downturn. This healthier balance of industry has led to what he believes to be a healthier demand for space in the city's economy.

He also noted that our “true growth” has increased from 17 percent to 46 percent in the time period that our economic drivers changed. He expects the cranes to follow accordingly, and as business demands increase, Denver will have to prepare to foster an environment that can house all of their needs.

"I don't care what industry you're in, which of the sectors. Everybody's in a war for talent, and what they want to do is be where the talent wants to work. So what the developers have to do is figure out where that is," said McCabe.

Some of these cranes will help build multi-family units.

Pete Schippits, senior managing director for real estate company CBRE Group, took to the stage to address 'where the cranes will go' for multi-family units. According to Schippits, we are nowhere near the point of over-saturation in our downtown housing market, and in fact the opposite true. The downtown Denver area is underserved regarding available multi-family housing.

"Our belief is that we're far from overbuilding," Schippits said.

As more people begin to rent and the age demographics of the city continue to change, he envisions Denver’s new climate supporting much more growth in the housing area. Schippits addressed the amount of luxury apartments being built in the downtown area and said the influx of those types of apartments can be supported by the fact that the 40-54 year old age bracket is decreasing in home ownership in the area, making it ripe for these types of units.

He also noted that Denver could do a significantly better job of creating more housing per the number of jobs available. Currently, our ratio is 5.9 jobs for every apartment. For comparison purposes, the average in the United States is 6.1 and Seattle and Austin sit at 5.5 and 5.1 jobs respectively. In New York City, which is super dense, the ratio is down to 3.1 jobs per apartment, and that appears to be the direction Denver is headed as we continue to move toward increased density.

Schippits forecasted that if most factors stay stable in the Denver economy, by 2019 downtown Denver will have a lower job to apartment ratio than the rest of the metro area. He also encouraged business leaders and developers in the room to prioritize traits that will continue to attract growth. He noted that Denver only ranks 26th regarding cities’ green space, which could be problematic as many people have moved to the city with the assumption that it is ‘outdoorsy.’

Lastly, Schippits noted that transit-oriented development (TOD) might not be the holy grail many speculators and Denver have promised. Houston, Austin and Dallas are projected to have the most office jobs in upcoming years. None of those cities particularly obsess over the TOD model of development.

If we want to keep cranes in the sky, we might need to check our priorities.

Paul Washington, real estate company JLL’s market director for the Rocky Mountain Region, noted that Denver is set up for tremendous growth over the next couple of years and has an excellent infrastructure but will need to rethink some of its priorities if it wants to sustain this growth.

To keep the city’s economic engine humming, Washington suggested we focus on three key areas, which include costs, jobs and an educated workforce. Denver is increasingly gaining a reputation as an expensive city, he said, and that may not serve it well in its long-term growth. He also said it must be a focus of the city to graduate local students, creating a competitive workforce that is homegrown as opposed to recruiting talent from elsewhere in the country.

"Denver, I don't think, is competitive as it could be in this robust economic cycle," Washington said, noting that our peer cities like Austin have done a significantly better job of establishing good relationships with their flagship universities and that that type of leverage is underutilized in the Denver area.