The number of unemployment claims made by Denverites since the COVID-19 closures began are extremely high. That's bad. And we don't know just how bad it is given the endless what-ifs brought to us by the pandemic.

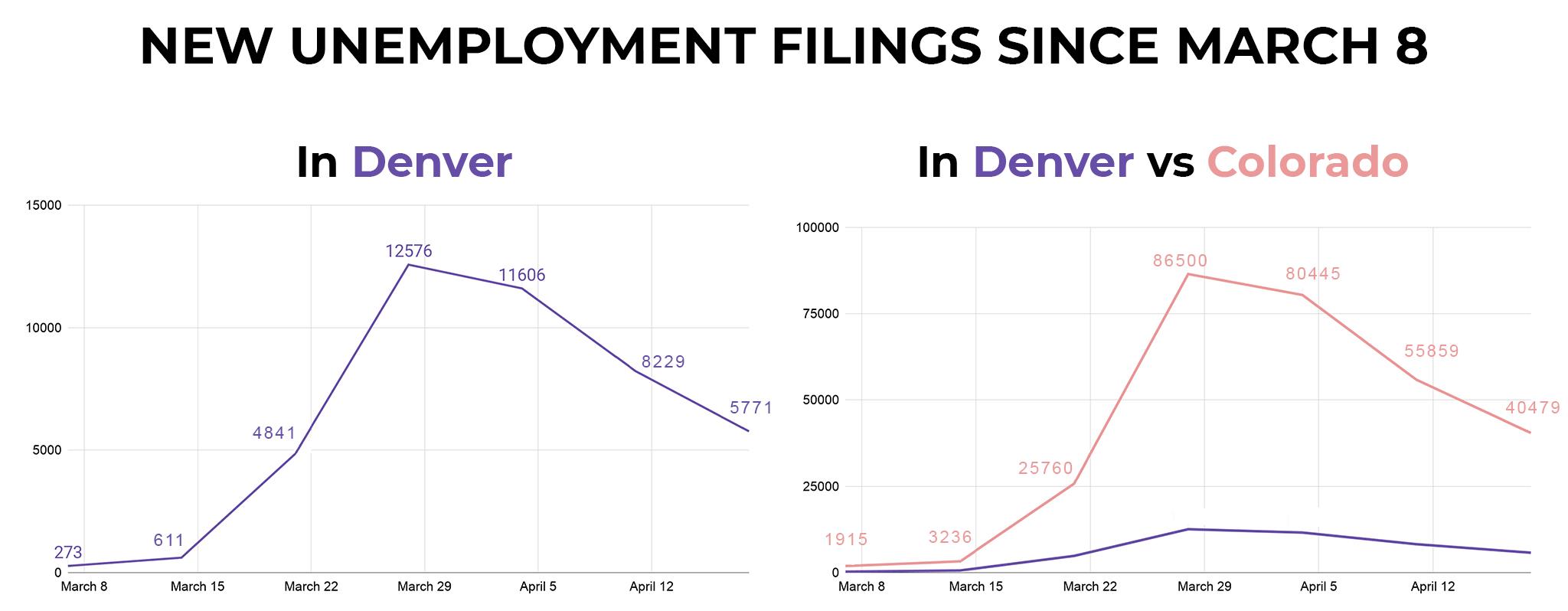

Nearly 44,000 locals filed for unemployment benefits between March 7 and April 18, according to the Colorado Department of Labor and Unemployment, an average of about 7,318 per week. In 2019, the weekly average was 260.

Don't be fooled by the downward slope in the above graph. The line represents new unemployment claims each week, meaning overall claims are still rising, albeit more slowly. That's what we know. What we don't know is, well, most things.

It's unclear how permanent these job losses are.

The U.S. private sector shed more than 20 million jobs in April, according to payroll company ADP. Losses that big will include jobs that have simply vanished. But while some local businesses are closing for good, not all will. Some restaurants, for instance, will stay open but shed staff.

The permanence of the jobless surge is one of many mysteries sponsored by the pandemic, said Andrew Friedson, assistant professor of economics at the University of Colorado Denver.

"When it comes to jobs, it's difficult to know how many jobs are lost and how many jobs are just pushed off until later," Friedson said. "Because it's difficult to know how much of it is demand being held back that's going to come back into the economy once people feel safe participating."

Brendan Hanlon, the city government's chief financial officer, has repeatedly said that the length of the pandemic and the accompanying restrictions to business-as-usual are the biggest factors in Denver's economic recovery.

It's unclear if and how people will spend their money -- if they spend at all.

As Denver businesses ease open, jobless Denverites will have less money to prop them up. Even locals who've kept their jobs might balk at spending their earnings because they're worried about an unstable economy -- or their health.

"Confidence is being dampened in two different ways," Friedson said. "One is we're under advisory orders and legal orders and whatnot and we can't go spend. But the other side of it is that even if you got rid of all these shelter orders, that doesn't necessarily mean that people are going to feel safe spending. Some people will, but some people are still not going to want to go out and participate in the economy."

Stephanie Morrison of Capitol Hill lost her job as a hairstylist and filed for unemployment benefits March 14. She said she never gets takeout and closely watches her money. Morrison is living off of her savings -- she says she's lucky to have some -- and won't be spending freely as Denver reopens.

"My friends are bartenders, my friends are tattoo artists. That's the world I live in," Morrison said. "I won't be returning to those places because I can't. I'm living off my savings, so I can't support my friends."

Morrison, who is also a self-employed real estate professional, was finally approved for unemployment benefits in late April after a typically frustrating experience with the state labor department. She has yet to receive a check.

We'll know more as more data becomes available.

Jobless claims are different than the unemployment rate, which accounts for the number of people looking for work but cannot find it.

"It's entirely possible that some of these people who lost jobs just aren't going to try to find one right away," Friedson said. "It's also possible that some of these people found one right away."

Denver's unemployment rate in March was 4.7 percent, according to the Bureau of Labor Statistics. With a 14.7 percent national unemployment rate in April, Denverites can expect a scarier number when the local estimate is revealed.

City-specific unemployment numbers come out May 22, said Ryan Gedney with the state labor office.

Who is looking, who is not, and what's available is difficult to know right now, Friedson said. For one thing, unemployed Coloradans are making more right now than they did before they were laid off because of state benefits combined with a federal bump. For another, economists are wading through April unemployment numbers, which were just released Friday.