Matthew Chavez bought his home in Westwood in 2010. He said he chose the house largely because of the property tax rate: $700 per year for the 500 square foot property.

But since then, his taxes have jumped to around $1,300 per year and will likely continue to rise. Between 2021 to 2023, single family property assessments in Denver have increased by a median of 33%. That led to a massive increase in homeowners contesting their assessments, including Chavez.

"I'm really not too happy about it because this house is not even on a foundation," he said. "It's sitting on cinder blocks."

Chavez, who has a disability, said he's comfortable living there and isn't keen on moving. He typically applies for tax relief to make ends meet, but is also in the middle of appealing his assessment.

He's not alone. Denver assessor Keith Erffmeyer said that in the 29 years he has worked for the city, his office has typically processed around 12,000 to 13,000 appeals each assessment period. This year, he received around double that, with 24,711 appeals.

Erffmeyer chalked up the spike in appeals to the large rise in assessment values, attributed to a rise in housing costs across the city in recent years.

"Given the fairly significant increase in values, that undoubtedly is a reason for the greater number of appeals this time around," Erffmeyer said. "When you're going through an escalation of real estate prices, and you're looking at it like a month at a time, it isn't nearly as shocking or revealing as when you take a two-year look at the change."

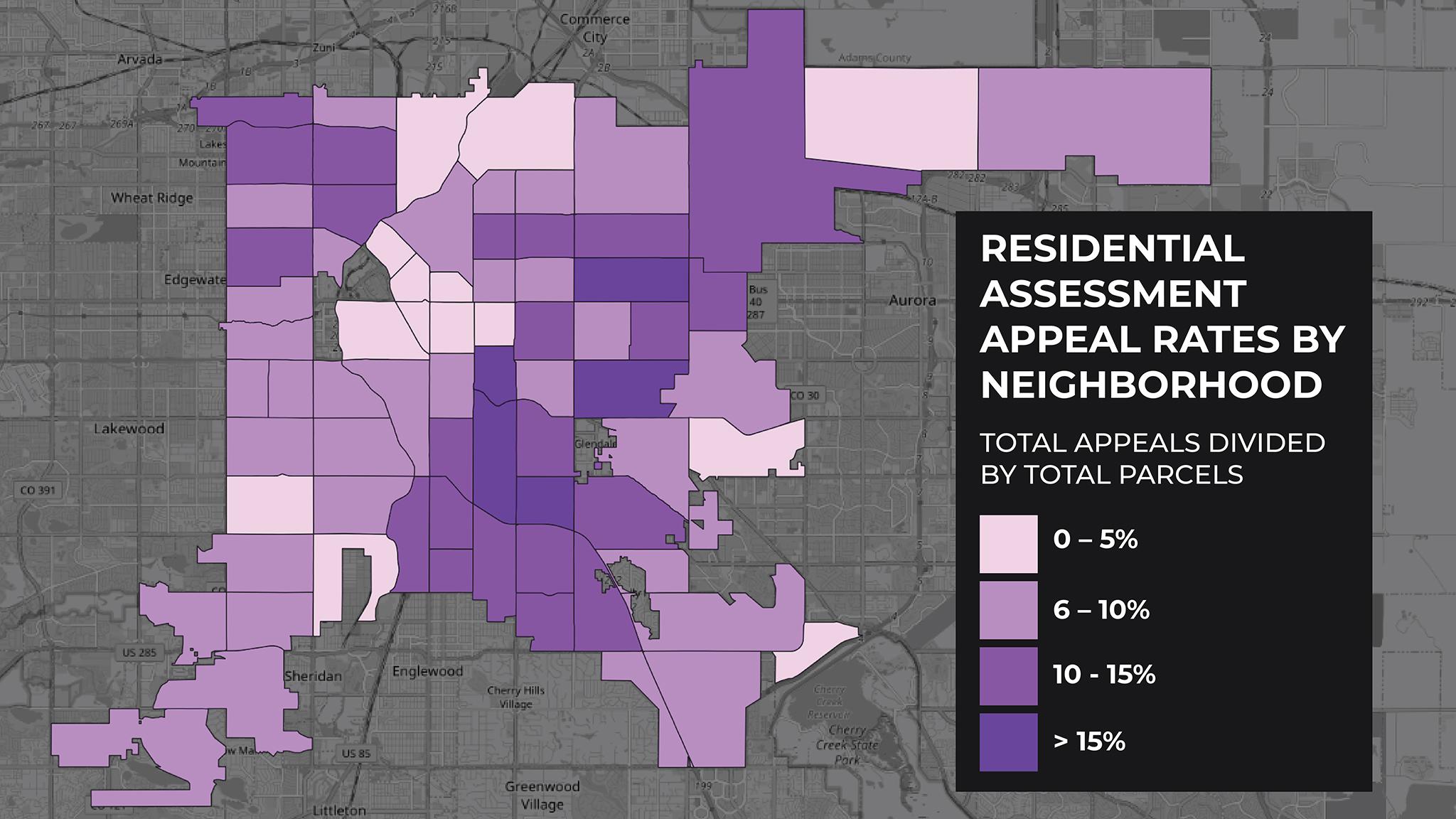

Homeowners contested assessments all over the city, but it was more common in wealthier neighborhoods.

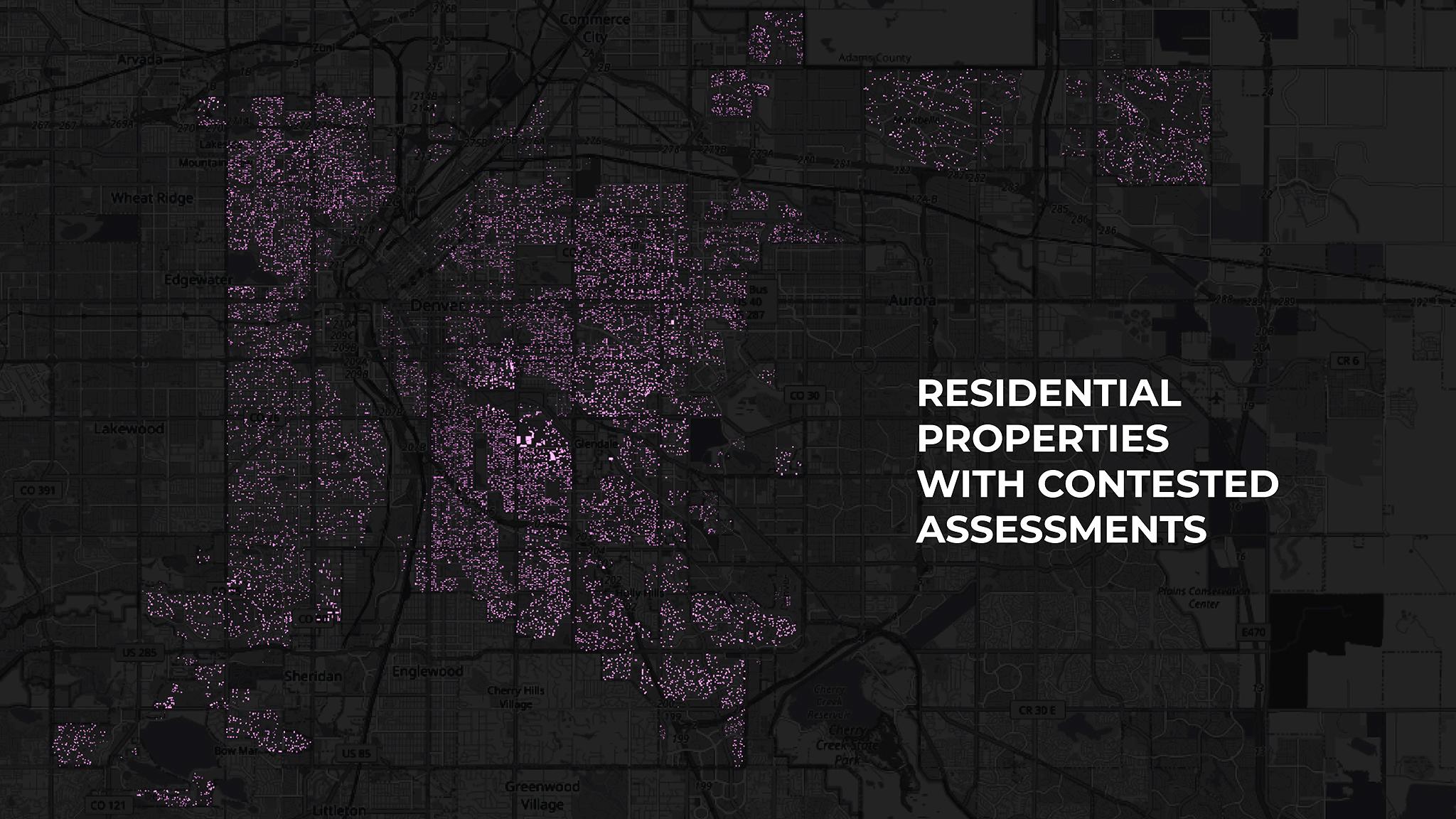

We analyzed a list of contested addresses that the assessor's office sent to us. Residential properties - 18,060 of them - comprised 73% of all appeals. When mapped, you can see they are all over the city.

Central Park had the most of any statistical neighborhood, with over 13,000 appeals, but it's also one of the city's largest neighborhoods. Country Club residents filed 1,302 in total. That's about 17% of all residential parcels within Country Club's boundaries, distinguishing it as the neighborhood with the highest proportion of contestations. Washington Park West and Cory - Merrill, to the south and southeast of Country Club, also ranked in the top five as far as proportion.

Citywide, neighborhoods with lower contestation rates loosely follow Denver's "inverted L" pattern. These areas tend to be less white and less affluent than other areas, along the city's western and northern bounds.

Derek Visocky, who bought his home in Country Club in the late '90s, said he's filed assessment appeals three or four times over the years. In general, he's glad property taxes fund schools, but he said the valuation increase of his home this time around was more than he expected. He suspects his home, which sits right on busy 6th Avenue, was compared to neighbors further from the loud drag.

"I look at property taxes as supporting the public school system, and I don't mind floating the boat a little higher for everybody," he said. "But this time was ridiculous."

In Central Park, Elisabeth Shippey said she's already contending with a $4,000 special district tax, a levy put in place by the neighborhood's developer to pay for initial construction. It's one reason why she made an appeal for her home.

"We are already overtaxed as it is," she told us.

While a lot of individual homeowners asked the city to take a second look, many appeals were filed by corporate landlords. American Homes 4 Rent, a company that owns houses all over the country, filed 123 residential appeals this year, followed by a list of landlords who filed 10-30 appeals each. American Homes 4 Rent did not reply to our request for comment.

Higher home values will naturally mean that homeowners pay more in taxes, but the city has a process in place that prevents massive jumps every year.

Erffmeyer explained that, ahead of tax season, city officials and staff set the mill levy that helps regulate how much property taxes rise. He said that when assessment values spike, city code requires that the mill levy be lowered to prevent massive fluctuations in property taxes.

That means that property owners will likely not see a one-to-one correlation between assessed value and their taxes. But city officials have not yet set the mill levy, meaning it's hard for the assessor's office and owners to calculate or predict the exact tax amount until that bill arrives in the mail.

"The best I could do is assure them it's not going to be 30%. It will be less than that. But it's not going to be like 4% either," Erffmeyer said. "It would be nothing more than a guess on my part because there's so many things undecided at this point in time."

State Democrats are also pushing a November ballot measure that could lower property taxes statewide.If Proposition HH passes it would lower property taxes and recoup that money by shrinking TABOR refunds from income taxes.

While tax bills will come in January, the assessor's office has until Aug. 15 to respond to everyone who sent in appeals. Erffmeyer said his office is fully staffed and working overtime to get through all the appeals.

"We're not upset that we got this many appeals, we're in a way flattered that people are actually paying attention to what we do. We tried to get the word out. The word I think did get out, and we have folks that are exercising their right to ask us to take a second look at it, and we're more than happy to do that."