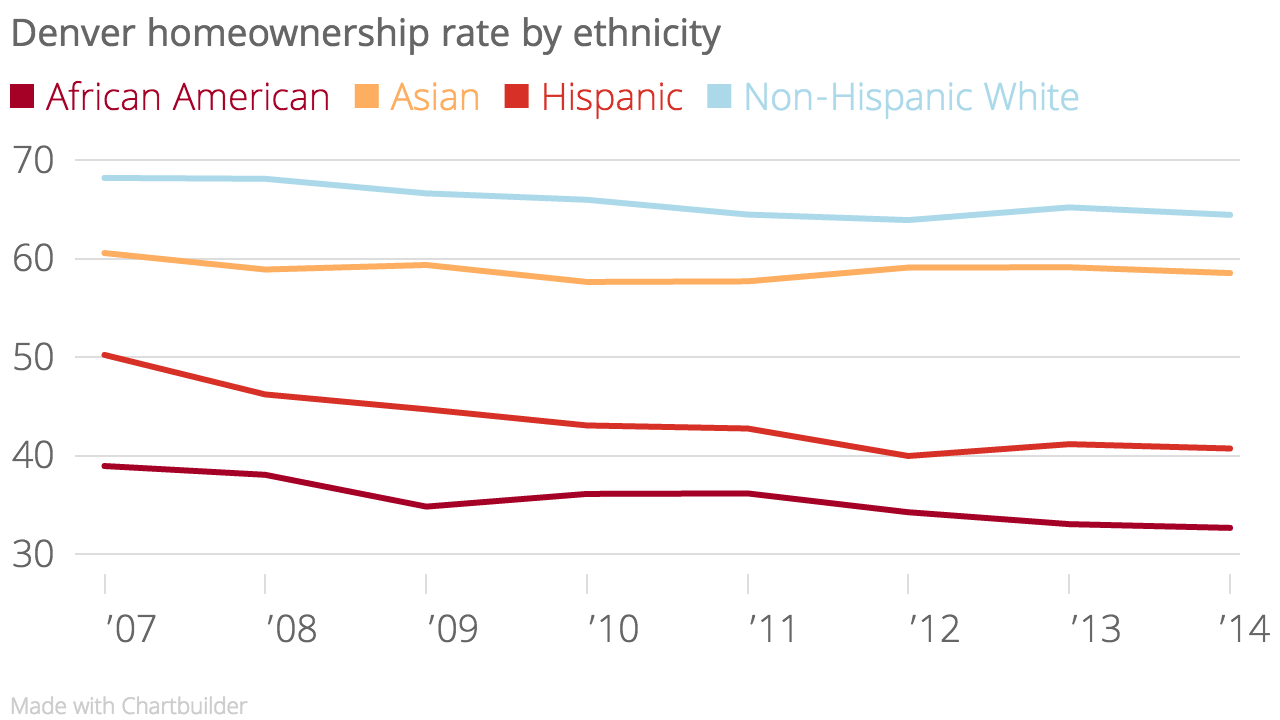

That Great Recession was no joke -- Denver homeownership rates went down for everyone over a seven-year period, according to census data analyzed by Apartment List:

But Denver's Hispanic community saw the largest dip in homeownership over that time, 9.5 percent.

The Hispanic community was hit even harder because of subprime mortgages, says Sam Cardenas, president of the Denver's chapter of the National Association of Hispanic Real Estate Professionals. Those loans, now regarded as risky and costly, disproportionately were given to people of color.

"It's taken them at least up until I would say you know '13, '14 for that segment of the population to truly recover," Cardenas said.

"But we have one of the hottest real estate markets in the country now. As it pertains to Latino and Hispanic homeowners, I would say they're getting in the game," he said.

And it's especially important to Cardenas that younger Latino homeowners get in the game too. If they don't act in the next two or three years, he thinks that they'll be priced out of the Denver market in the next five. Plus, renting in Denver isn't looking so hot; costs have gone up over 17 percent since 2007.

Housingwire reports that Hispanic millennials often struggle to come up with a down payment and are more likely to use a gift to pay their down payment on a home. That's true in Cardenas' experience.

"A lot of times, [the younger generation is] teaming up with mom and dad and grandpa to be able to buy houses," he said.

There are also special lending programs for first-time homebuyers. But to take advantage of those programs, you have to be aware of them.

Sometimes that presents another challenge for Colorado's Hispanic community.

"In Boulder County, we have English homebuyer classes that disseminate a lot of this type of information," said ERA Tradewind Realtor Marta Loachamin. "There's a class offered every month. Last month they had over 90 people RSVP for their class. The Spanish-language class, there's not enough information shared about the resources, so they only can offer that class every other month."

The bigger picture, Loachamin says, is that homeownership is a facet of being able to build wealth. And she notes that Hispanic households had only $13,700 in household wealth in 2013, compared to $141,900 for white households, according to the Hispanic Wealth Project.

"It doesn't matter if our population continues to grow the way it will continue to grow, if we're in the same level of inequity when it comes to finances and ability create wealth, it puts us at a standstill," Loachamin said.

For more information on home buying classes around the state, check out the Colorado Housing and Finance Authority schedule.