Cannabis social media network MassRoots Inc., cut 40 percent of its work force after defaulting on debt payments of $966,000.

In a Sept. 21 filing, the cannatech company disclosed that it was unable to make required payments on its debt.

In an attempt to make up for the debt, a separate filing Monday disclosed that MassRoots had to lay off 14 of 33 full-time employees, shed vendor agreements and implement new technology in order to save $146,000 per month.

“It’s not an ideal situation, by any stretch of the imagination,” Isaac Dietrich, MassRoots chairman and chief executive officer, told the Cannabist.

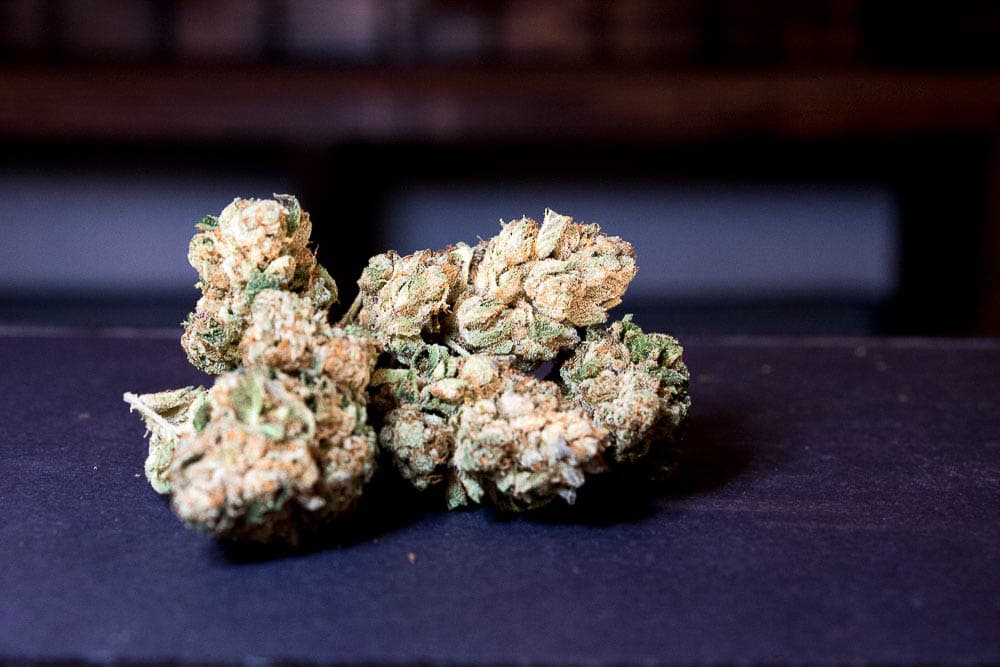

MassRoots is a cannabis-centric social media network and app that launched in 2013. It connects its more than 900,000 users to local dispensaries and industry news, and encourages photo and video sharing.

In January 2016, the company filed for $3 million in capital, and in March took out $1.42 million in promissory notes to fund operations.

The debt was secured with a six month term against MassRoots’ common stock, BusinessDen reported.

After failing to make the debt payments in-time, MassRoots issued more than 300,000 shares of common stock to its creditors. Some creditors chose not to convert and have taken no action as of Tuesday, the Cannabist Reported.

“I don’t think that these creditors want to see the company fail,” Dietrich told the Cannabist.

These developments dealt another blow to MassRoots during what has already been a rough year.

In May, MassRoots applied to convert its stock up to the Nasdaq, but was denied. The move would have opened up MassRoots to more investors and made it the first cannabis company to be publicly listed.

“With this decision, we believe that the Nasdaq has set a dangerous precedent that could prevent nearly every company in the regulated cannabis industry from listing on a national exchange,” Dietrich said in a statement. “This will have ripple effects across the entire industry, making it more difficult for cannabis entrepreneurs to raise capital and slow the progression of cannabis legalization in the United States.”

Despite the default and Nasdaq decision, Dietrich sounded optimistic in a Monday memo to shareholders, citing recent accomplishments.

In February, the MassRoots user base exceeded 775,000. Revenue in q2 was greater than revenues from all other quarters totaled. And in August, MassRoots added a dispensary finder to its mobile app, and plans to roll out a Yelp-like strain reviewer and pricing guide within the next couple of weeks.

With the coming election, MassRoots expects further legalization to greatly expand the customer-base to cannabis users more states.

Dietrich said he expects these innovations and cost-cutting measures to make MassRoots cash-flow positive, though the company reported net losses of $2.4 million and $8.5 million in 2014 and 2015 respectively.

Multimedia business & healthcare reporter Chloe Aiello can be reached via email at [email protected] or twitter.com/chlobo_ilo.

Subscribe to Denverite’s newsletter here.