In a hearing that stretched for more than seven hours Wednesday and included testimony from more than 70 speakers, the House Transportation Committee advanced HB 1242, the compromise transportation funding measure, on an 8-5 party line vote.

"After many, many years of kicking the can down the road, now in 2017, we will finally be asking our voters to approve a sustainable, predictable, long-term funding system," state Rep. Diane Mitsch Bush, a Steamboat Springs Democrat and chair of the House Transportation and Energy Committee, said in urging her colleagues to vote yes.

Only the Democrats did, though.

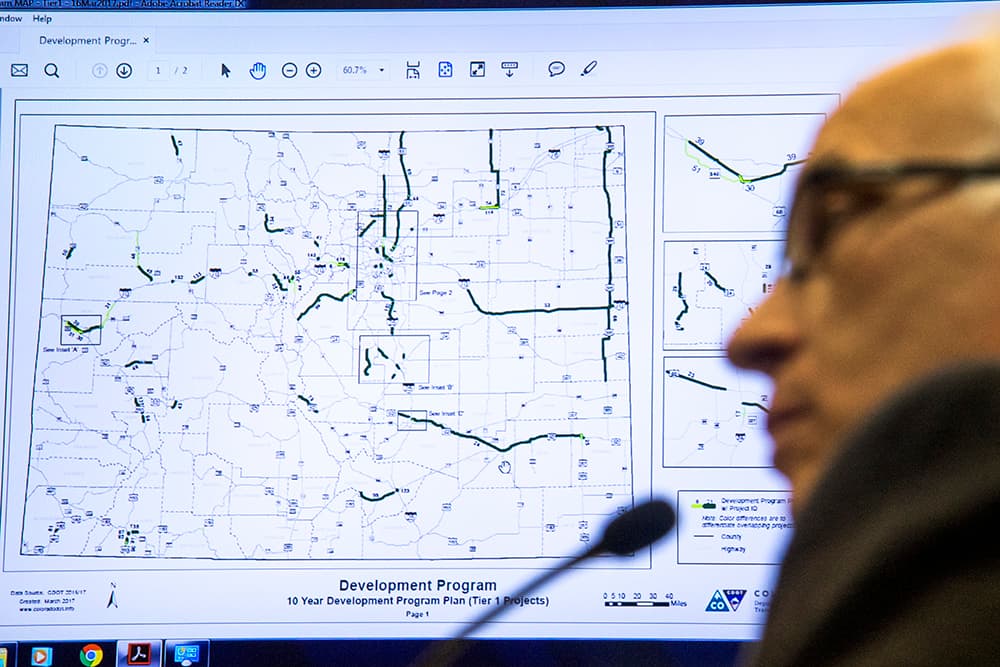

Rolled out earlier this month, HB 1242 would ask voters to approve a 0.62 percent sales tax, bringing the total state sales tax to 3.52 percent for the next 20 years, with the revenue dedicated to transportation spending. The original bill called for $300 million in new revenue plus $50 million in existing revenue to be given to CDOT each year to fund a $3.5 billion bond program based on the agency's priority list. The rest of the money -- the sales tax will bring in an estimated $690 million a year -- will be divided with 70 percent being distributed to local governments for their transportation projects and 30 percent going to a new multimodal options fund.

While the compromise proposal has the support of Senate President Kevin Grantham and Senate Transportation Committee Chairman Randy Baumgardner, most Republicans in the state legislature have expressed varying levels of dismay with the bill.

The bill, which needs to get past both the Republican-controlled Senate and Colorado's tax-averse voters before it would actually do anything, came out of the committee a little different than it went in. Perhaps the most significant change was an amendment from Rep. Jon Becker, a Fort Morgan Republican, to eliminate the vehicle registration late fees that were implemented under FASTER to raise money for transportation. The bill already reduced registration fees for the 20-year period of the transportation tax, which would reduce revenue to the state by an estimated $80 million, while the late fees account for another $20 million in revenue. Adopted in 2009, FASTER fees have been a significant source of transportation funding.

Democrats also agreed to increase the amount of money from the 0.62 percent sales tax increase that would be dedicated to CDOT from $300 million to $375 million, but they insisted that it should remain a flat amount rather than a percentage of the tax revenue generated by the increase, as Republicans and many business advocacy groups wanted.

The big sticking point for many Republicans is the tax increase, but during the committee hearing, GOP members focused on the funding formula.

In addition to wondering if 30 percent for multimodal is too much, Republicans on the committee wanted the CDOT money, the $300 million, to be a percentage of total tax revenue rather than a fixed amount. As Colorado's economy continues to grow and the state takes in more sales tax revenue, the percentage of the tax increase that goes to CDOT and the statewide roads system will go down, while the share available to local projects and multimodal will go up.

"We haven’t solved a lot of the issues I have with the bill, and one of those issues is funding for the state," Rep. Polly Lawrence, a Republican from Roxborough Park, said. "If we’re talking about doing projects statewide, having a fixed amount in there for the calculation isn’t going to do it."

Two members of the committee, Republican Reps. Terri Carver of Colorado Springs and Perry Buck of Windsor, have their own transportation funding bill that would ask voters to approve up to $3.5 billion in bonds without raising taxes and sets aside 10 percent of sales tax revenue to pay back the bonds and fund other transportation needs. The bill doesn't address the larger budget context or what would have to be cut to make room for the set-aside for transportation. It's assigned to the House State, Veterans and Military Affairs Committee, known as a "kill" committee.

At the same time, state Sen. Jerry Sonnenberg, a Sterling Republican, is working on his own transportation bill that would take general fund money that currently goes to transportation and assign some of it to support a much smaller bond program of around $1.7 billion, with more money going to projects in rural areas.

Many of the speakers expressed support for the bill while asking for tweaks ranging from transit fare reductions to offset how regressive the sales tax increase would be to more money for CDOT and less for transit. A string of Denver metro area mayors from across the political spectrum expressed support for the sales tax increase, even though it will decrease their own ability to raise sales taxes locally.

"We don’t believe it’s our first choice, but it might be our only choice," said Mayor Cathy Noon of Centennial of a sales tax increase. The proposal isn't polling great, but it polls better than a gas tax increase.

“There’s a lot of unity in dislike of traffic," Golden Mayor Marjorie Sloan said.

Fix Colorado Roads, the coalition of business interests supporting a transportation funding package, said the measure is a good start but still falls short.

"HB 1242 is the culmination of conversations that have been taking place over two years," spokeswoman Sandra Hagen Solin said in a statement after the hearing. "While our group is encouraged by the initial intent and introduction of HB 1242, amendments passed tonight didn't address the areas of concerns."

They said the proposal needs more "balance" and, to increase its chances of passing, the state should dedicate more existing general fund revenue to transportation and create a list of signature projects that will definitely get funded.