Earlier this month, Mark Soukup divided the hundreds of pages in the new tax reform among four other people in his tax firm so he could prepare a national webinar for tax preparers.

Soukup and his team at Soukup, Bush & Associates in Fort Collins each spent almost 48 hours during eight days trying to interpret what the recently passed Tax Cuts and Jobs Act means.

"It's a neat law, and it's going to be a good law. But it's a paradigm changer — a total paradigm changer," Soukup said. "Even after having five people around me spend 50 hours each and me preparing a two-hour presentation and rereading it, I still have a couple pieces on this thing that I'm uncomfortable saying I know right off the top of my head. It's very, very complicated."

Colorado tax preparers have a lot of reading and preparing to be ready to handle 2018 tax filings for people and businesses. And taxpayers are already asking questions ahead of the Internal Revenue Service providing guidance.

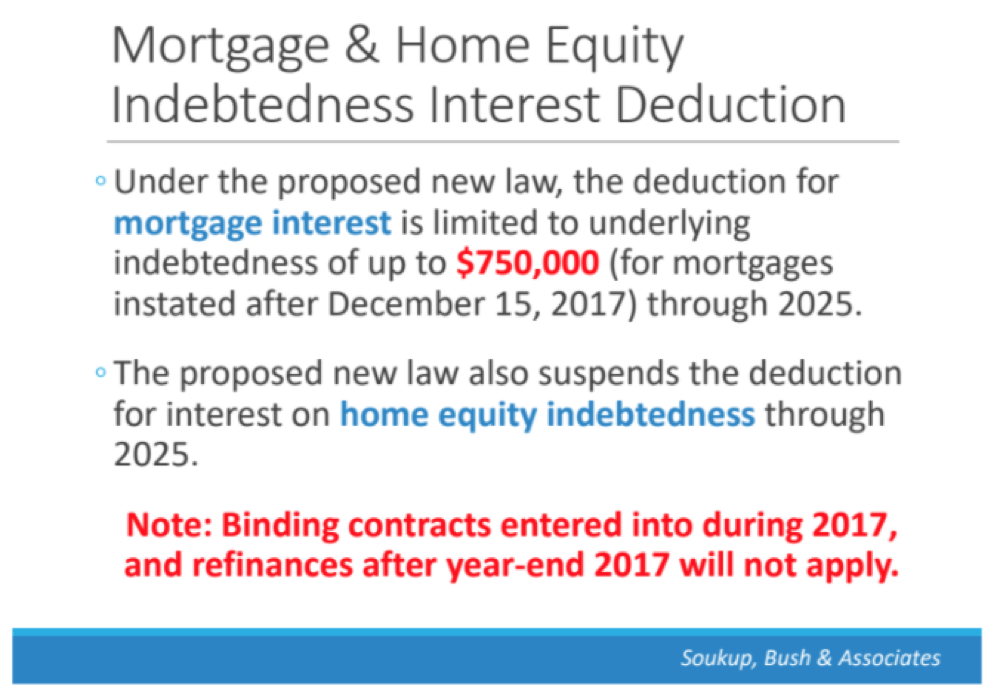

An example of the miscommunication already taking place involves a tax deduction for property owners. Across the country, people are rushing to pay their property taxes on their homes to get the current deduction before the new bill goes into effect Jan. 1.

"The city and county of Denver has seen a sizable uptick in the amount of people wanting to pay their 2017 property taxes early," said Courtney Law, spokeswoman for the Denver Department of Finance.

"Residents will receive their 2017 property tax bills in mid-January 2018. We are not issuing property tax bills early, but we will tell them how much they will owe," Law said.

The IRS said Wednesday that individuals who rushed to prepay their property taxes based on estimates about how much they’d owe would not necessarily get a bigger deduction.

Soukup will be one of the people who gets Colorado tax preparers ready to handle individuals' and businesses' 2018 taxes. He works with the Colorado Society of Certified Public Accountants, providing continuing education support for the Englewood-based organization. For the last three decades, he has traveled the state to help CPAs get up to date with the latest tweaks to tax regulations.

"Last time we had a really complicated tax law was in 1986, so it's been 31 years," he said. "This one is probably double to triple the size of the next biggest tax law between '86 and now."

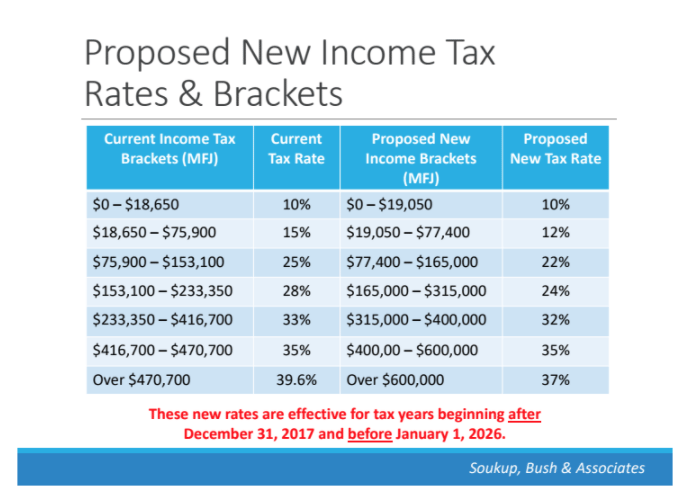

TurboTax owner, Intuit, says most tax filers won't have to really worry about the changes during the 2017 tax season that opens next month. However, the company's competitor, H&R Block, says that "virtually all taxpayers" will be affected by the GOP's tax reform legislation and that workers will start seeing changes to their paychecks around February.

Gerald Spivey is master tax advisor in Denver for H&R Block. He said the company is just now getting the specifics on the new law but wants to be ready to tackle filers questions when the tax season opens Jan. 23.

"It looks pretty daunting, I have to admit," Spivey said. "We're going to be looking at different strategies to get the best possible tax outcomes for everybody."

Spivey said he's expecting to get a lot of questions about deductions for mortgage holders and personal exemptions. Overall, both he and Soukup believe most Coloradans will benefit from the reform.

Soukup said Coloradans are not significantly harmed by the $10,000 cap on so-called SALT items — state and local tax deductions — because we have lower tax rates than taxpayers in other states. Those in the Centennial State will also likely benefit from the 20 percent flow-through deduction and the larger standard deduction.

However, economists for the state expect people to end up paying more in state income taxes. With changes in deductions, many people will end up with more taxable income, even if they're paying federal taxes at a lower rate.

"Everybody is going to get a tax cut in the state of Colorado, the few people that don't have real unique situations going on," Soukup said.

Spivey echoed that saying, "For the most part, it appears most people are going to have positive changes. But regardless of that, most people just want to know what the new landscape is going to look like and what they need to do."

Want more Denver news? Subscribe to Denverite’s newsletter here bit.ly/DailyDenverite.

Business & data reporter Adrian D. Garcia can be reached via email at [email protected] or twitter.com/adriandgarcia.