The Mental Health Center of Denver is partnering with state Rep. Leslie Herod to campaign for a half-billion dollars of new spending on mental health, addiction services and housing over the next decade.

They want local voters to decide whether to raise city sales taxes by 25 cents per $100 of spending on restaurant meals, consumer goods and more. The hike is expected to generate about $45 million in its first year.

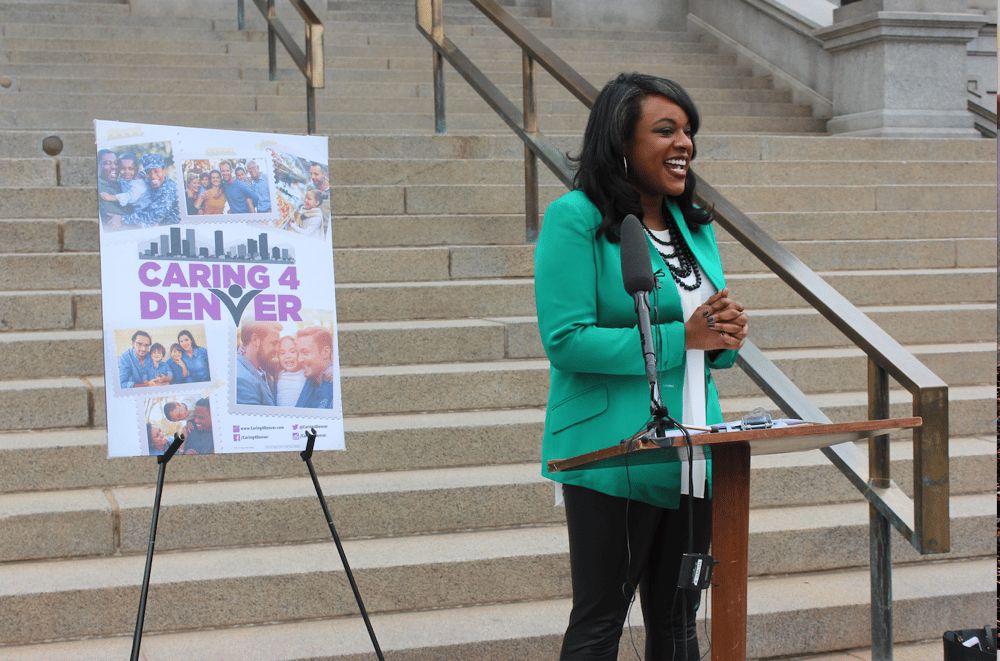

“Denver cares about people suffering from mental health and substance abuse issues, because a crisis can strike at any time,” Herod said in a news release. “We need to help prevent suicides and save lives, with treatment for children and adults that helps them lead healthy lives -- and in Denver, we will.”

Currently, Denver residents pay a total of 7.65 percent tax on most goods, including state taxes. The new proposal would bring that to 7.9 percent. (Food and drink taxes are slightly higher. However, groceries are exempted.)

This will likely be on the November ballot.

The "Caring 4 Denver" campaigners need to collect about 4,700 signatures over the next few months in order to get the proposal on the November 2018 ballot. They're confident that will happen.

"For Rep. Herod, she’s spearheading this. It’s her idea and inspiration that has made this happen," campaign manager Gabe Claeson said in an interview. Herod, a Democrat, represents Denver in the Colorado state legislature.

MHCD, one of the largest service providers in Denver, is a central backer of the proposal. District Attorney Beth McCann also is among the early supporters.

If approved, it would go into effect Jan. 1. The money would be managed by "an independent board of stakeholders in mental health and substance abuse services."

The money could be spent on:

- Suicide prevention

- Mental health services and treatment

- Opioid and substance abuse prevention, treatment and recovery

- Affordable housing and services to reduce homelessness and keep people out of jails and hospitals

This would be somewhat unusual for Denver.

Almost all of the local sales tax goes toward the "general fund," meaning it can be used for many city purposes. Only a small portion of the city sales tax is set aside for a specific purpose, the Denver Preschool Program.

The new money -- estimated at $45 million for the first year alone -- would be a significant boost to spending on these issues. One helpful comparison is to the current budgets of the state's community mental health centers, which have similar missions to those in the proposal.

"If you look at funding for the 17 mental health centers in Colorado ... that’s about $600 million. If you look here in Denver, we're at about $100 million," said Dr. Carl Clark, CEO of the Mental Health Center of Denver.

"Adding $45 million to just Denver is a game-changer. It gives you the ability to make a significant difference in meeting people’s needs."

The campaigners say polling showed 79 percent support among likely voters. However, Denver voters do have their limits: They rejected a smaller sales tax proposal for college funding in 2015.

And this isn't the only tax hike that will be battling for voters' attention. A statewide proposal would raise money for roads by increasing statewide sales taxes by up to 1 percentage point.

The idea of a sales tax also could attract criticism. Besides raising costs, sales taxes can be "regressive," meaning they can eat up a higher percentage of poor people's income than rich people's. However, Denver has tried to reduce that impact by exempting groceries, for example.

The Caring 4 Denver campaign argues that Denver's sales tax is a good source of money because it's currently among the lowest int he country.

Denver's local sales tax has been largely stable for decades. It has increased twice since 2007, growing from 3.5 percent to 3.65 percent. The state sales tax is slightly lower today than it was in 1965.

"Denver has one of the lowest total sales tax rates in the nation. Compared to the nation’s large cities, Denver’s tax rate falls in the bottom twenty-five percent," the campaign said in a written statement.

"This measure creates a significant dedicated funding stream for mental health and substance abuse, all while allowing providers to plan for years into the future."

The campaign linked to a 2003 study as a citation, which confirms that Denver's overall tax burden was among the lowest. A more recent study also confirms that Denver's overall tax burden is among the lowest 15 in the country.

However, Denver's sales tax is in the middle of the pack: 71st out of 118 large cities, according to one recent study.