Millennials are getting older and mortgages are getting more expensive.

For these reasons, the cost of buying a home in Denver is likely to keep rising for at least two more years, according to new projections from CoreLogic.

Let's start with interest.

Interest is essentially how much it costs to borrow money. When the interest rate goes up, so does the cost to pay your mortgage -- and the rate is definitely going up.

"We’ve enjoyed some really low mortgage rates the last couple years," said Frank Nothaft, chief economist for CoreLogic, at a housing summit hosted by the city of Denver's Office of Economic Development on Thursday.

That increase in borrowing costs, combined with rising home prices, could drive up monthly payments by 20 percent in a single year in some cases, he said.

There's also a secondary effect. Since it's getting more costly to buy a home, people are less likely to sell their homes.

" ... An increase of about 1.5 percentage points means that there are roughly about 100,000 less homes listed for sale per year in the United States," he said.

Mortgage rates fell from a pre-recession high near 7 percent to a recent low of about 3.5 percent. Rates could pass 5 percent again around 2019, according to CoreLogic projections. CoreLogic is a real-estate data company.

That would accelerate the biggest problem that already faces would-be homebuyers: There aren't enough homes for sale. Denver has one of the smallest supplies of housing relative to demand, placing it near Los Angeles, Seattle and San Francisco as of August.

"The inventory of homes available for sale in the market is really, really low," Nothaft explained to the crowd at the Hyatt Regency in downtown Denver. "It's increasingly lean."

Home values grew 8 percent in Denver last year, he said.

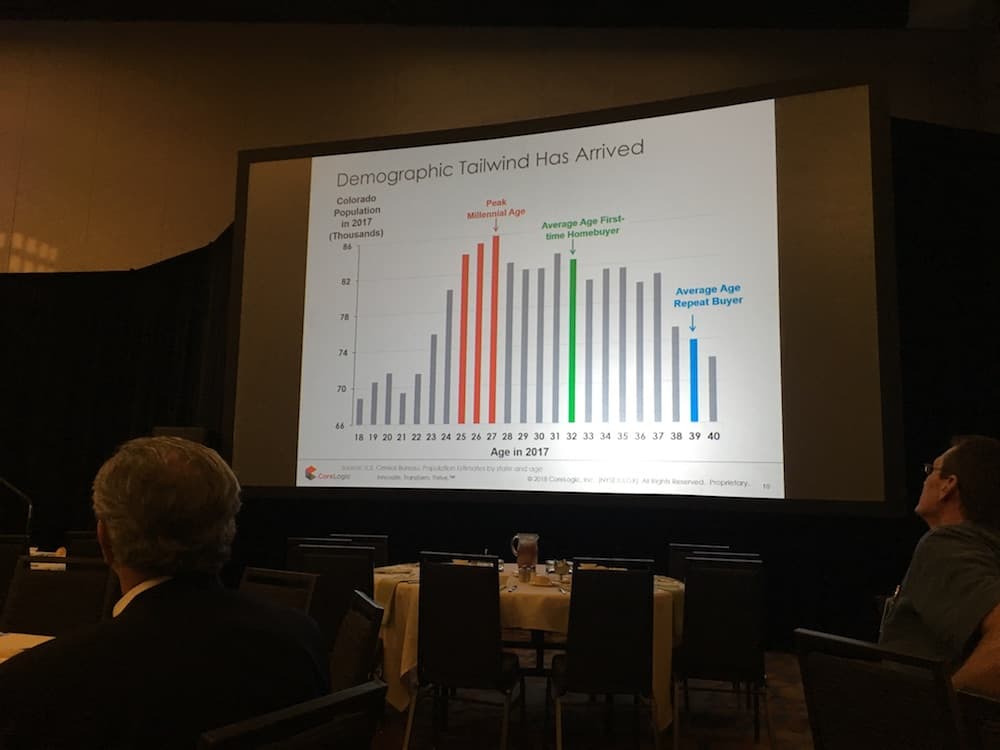

And demand is likely to stay strong, in large part because young people are getting older -- as one does.

"The largest part of the millennial cohort here in Colorado, right now, are those who are aged 25, 26, 27," he said. And the average first-homebuyer's age is 31, he said.

See where this is going?

There could be a lot more people looking to buy homes in the near future.

"We've got this acute shortage of supply, and this rising demand, because the economy's pretty good and because of the millennial cohort," he said. "It translates to strong price pressure, and it's a major reason why prices are rising rapidly in the U.S."

His firm expects that the United States home-price index will increase in value by 6 percent per year in 2018 and 2019.

In Denver, it could be 7 percent.

"The affordability challenges here in Denver are far more severe than we see in other places in the country," Nothaft said.

The average home price in Denver is up 83 percent over 2011, compared to a 54-percent gain nationally, according to CoreLogic figures.

Denver's home prices surpassed CoreLogic's overall U.S. home-price index around 2016, and the gap is expected to keep widening.