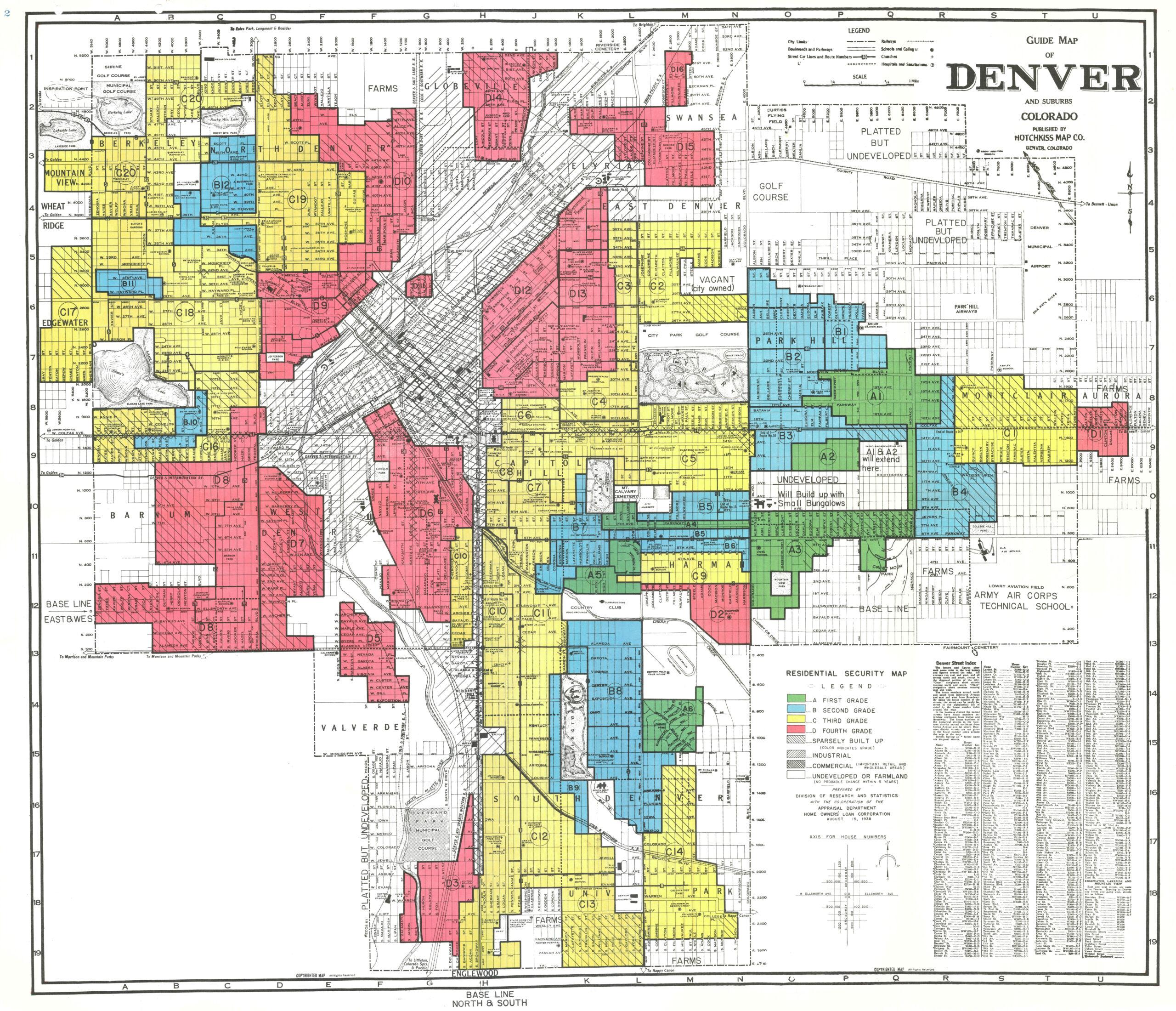

Denver's long history of redlining, through racist zoning and loaning practices, iced out Black, Indigenous and people of color from homeownership for most of the 20th Century.

Now the city's Department of Housing Stability (HOST), is trying to undo some of the damage through a new housing program that will offer forgivable homebuying loans to qualifying families. Those loans can be used to pay for down payments or closing costs.

The goal, according to HOST, is to combat gentrification and create racial equity in the homebuying process.

"We're focused on leveling the playing field for homeownership opportunities among all of our communities in Denver," Mayor Michael Hancock said in a statement.

The metroDPA Social Equity program will offer $15,000 or $25,000 to residents or people whose immediate family members lived in Denver neighborhoods that were redlined between 1938 and 2000. The money, from the established metroDPA program, comes in the form of an interest-free, three-year forgivable loan, and it can be used to pay for either a down payment or closing costs in one of 45 Front Range cities, including Denver, Thornton, Aurora, Wheat Ridge and more.

"'Historically redlined neighborhoods are defined as those neighborhoods labeled as 'D Fourth Grade' and colored red on the 1934 federal Home Owner's Loan Corporation Residential Security Map of Denver," according to HOST. In the mix: parts of Globeville, Elyria-Swansea, Barnum, Five Points, North Denver (now dubbed the Highlands), Edgewater and more.

Who qualifies and how to apply

To apply, people need to qualify for a 30-year, fixed-rate home loan, make less than $150,000 per year, and have a credit score above 640.

Those interested can find more information and the application on MetroDPA's website.

The program is funded through MetroDPA, which has been providing loans since 2013 and has already helped 4,000 households buy homes.

The new equity-focused program aims to increase homeownership for BIPOC residents from 41% to 45% by 2026.

"Far too many households, historically those in communities of color, have been excluded from the American Dream and the wealth-building it offers for these families," Hancock said. "This is a step in correcting that."