Tattered Cover, the beloved independent bookstore with multiple Denver metro locations, filed for Chapter 11 bankruptcy Monday.

"This is a reorganization plan," Tattered Cover CEO Brad Dempsey told Denverite. "It's a Chapter 11 case. So this is not a closure. This is not a liquidation of the company. We're doing this to take advantage of the tools of bankruptcy to make sure we get restructured and be a stronger company in 2024."

The bankruptcy filing, filed in the United States Bankruptcy Court for the District of Colorado, said Tattered Cover owes its creditors between $1 million and $10 million dollars. A list of Tattered Cover's 20 largest creditors include publishing giants Penguin Random House, Simon & Schuster and Harper Collins Publishers. Penguin holds the largest unsecured claim reported in the bankruptcy claim, amounting to about $375,000.

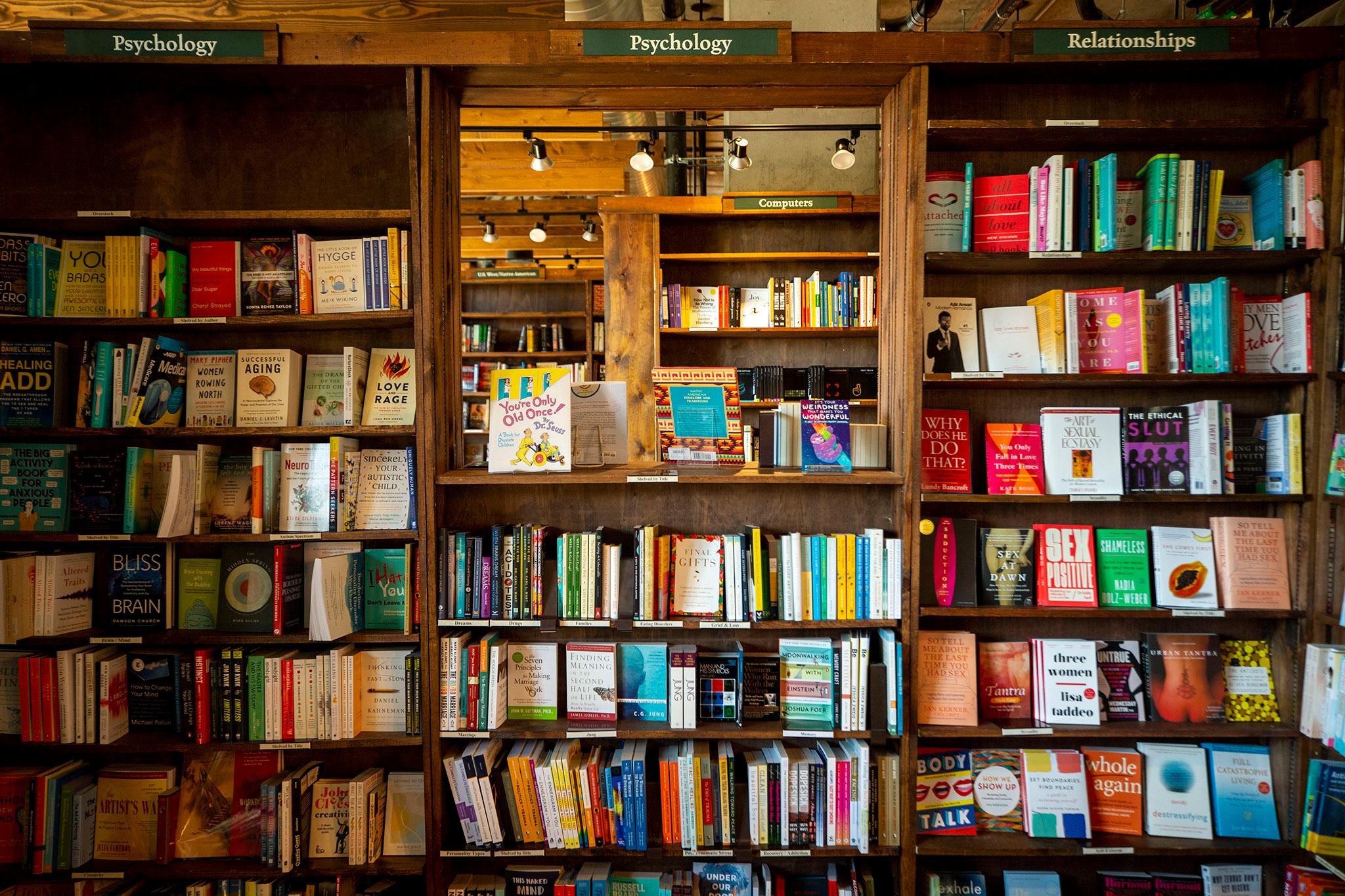

Dempsey said the company is currently spread too thin. Recent store visitors may have noticed emptier shelves, which Dempsey attributes to trying to provide limited inventory to its seven locations.

Under the Chapter 11 restructure, Tattered Cover will close their Westminster, McGregor Square and Colorado Springs locations next week. The closures will help the remaining locations stay stocked. Inventory from the Westminster and McGregor Square stores will move to the Colfax location, and the Colorado Springs inventory will move to the Aspen Grove branch.

"Our biggest challenge right now is getting our inventories back up to appropriate levels, not only for normal operations, but for the holidays," Dempsey said. "Reorganizing this quarter is the best time to do it because it should be our strongest quarter with the holidays, but we have to be able to get our inventories up at these stores."

The company will also lay off at least 27 people from its 103-person workforce. Dempsey said Tattered Cover plans to offer some of the affected employees seasonal positions as it gears up for the holidays.

Dempsey also expects a "very different ownership structure" by the time Tattered Cover is out of bankruptcy, which he expects to happen within the first half of 2024.

The long-standing bookstore has struggled to break even for years, with a new ownership team taking over in 2020 to stave off bankruptcy through rapid organizational growth. Since the new ownership team, Bended Page LLC, took over in 2020, it has launched multiple new stores, including moving their historic downtown store from Wynkoop Street to McGregor Square, and entering new markets in Westminster and Colorado Springs. That period was also marred by employee burnout, waves of resignations, and an investigation into workplace bullying.

The strategy embraced by Bended Page leadership was to stave off financial difficulties through rapid expansion and major investment. That gamble proved unsuccessful, and Kwame Spearman, a former Denver mayoral candidate and current school board candidate, resigned as Tattered Cover's CEO in April 2023.

"Anytime you expand like that, especially as rapidly -- I think we grew our square footage by nearly 47% in the span of a couple of years -- coming out of COVID was ambitious, but likely undercapitalized along the way," Dempsey said. "Not enough capital and not enough support and marketing structure to carry that out successfully."

Dempsey, a bankruptcy attorney by trade, took the helm of Tattered Cover on an interim basis in July. He was tasked with guiding the bookstore chain through its financial difficulties without bankruptcy protections, and if that failed, to steer the ship through bankruptcy proceedings. That's where things stand now.

Tattered Cover will have access to up to $1 million in debtor-in-possession financing, provided by "a newly created entity comprised of current company board members and investors," once the bankruptcy court approves its bankruptcy filing.

While the company's ownership structure appears to be up in the air, there is one thing set in stone. Dempsey told Denverite the "interim" part of his title was dropped once Tattered Cover submitted its bankruptcy filing Monday.