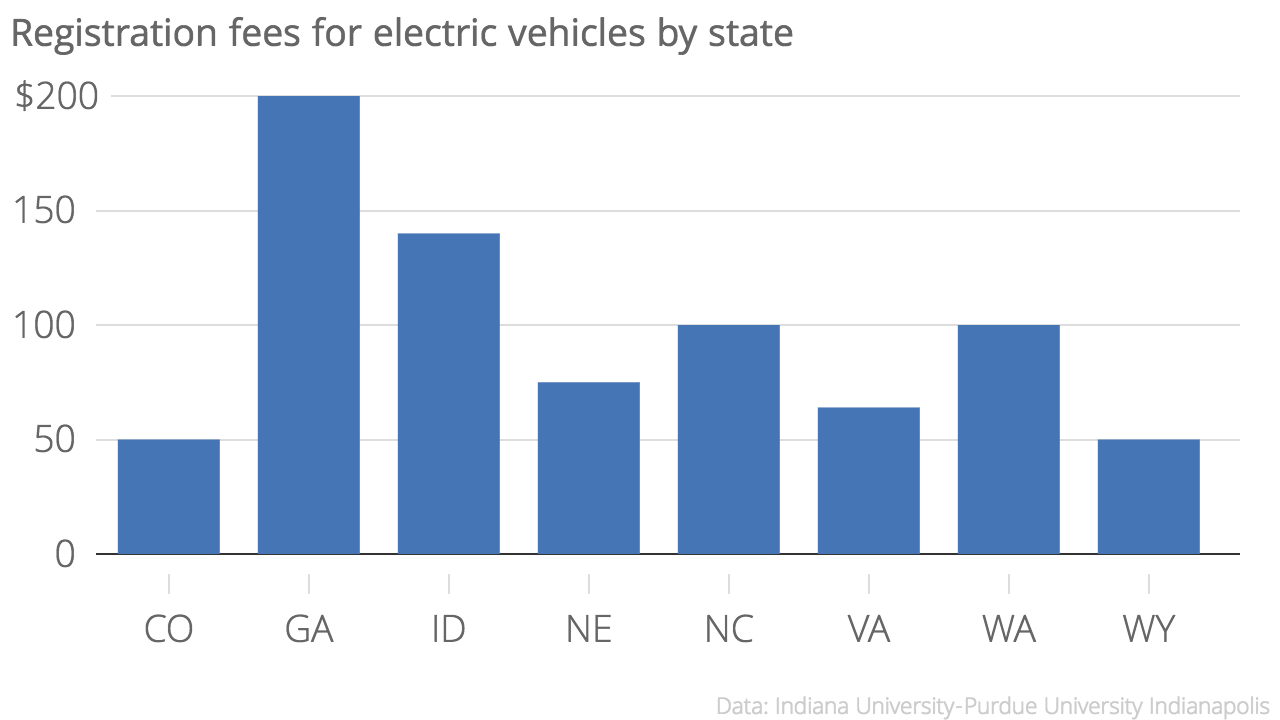

Every year, Coloradans who own a plug-in vehicle, typically an electric one, pay an extra $50 a year in fees. If you live in Georgia, it's $200. Either way, it's not a good way to charge those car owners for how they use the road, says a new paper from Indiana University-Purdue University Indianapolis.

The policy reason for these fees is that plug-in electric vehicles aren't buying gas, so they also aren't paying the gas tax. And because the tax charged for gasoline helps fund infrastructure, people with plug-in electric vehicles aren't paying their fair share.

In Colorado, $30 of the fee goes to the Highway Users Tax Fund. The other $20 goes to the Electric Vehicle Grant Fund, which pays for things like charging stations.

But there's also the $7,500 federal incentive to buy an electric car, plus Colorado's new $5,000 incentive. That amounts to a tax and a subsidy at the same time, says Jerome Dumortier, lead author of the paper criticizing the practice.

"We are not against taxing plug-in vehicles," he said. "We are just saying that this policy you have is inefficient and the policy does not account for differences in usage."

Dumortier says the inefficiency comes from having two policy tools at the same time. Eliminate either the subsidy or the fee, and then you save on administration costs, among other things.

Since the Colorado Department of Transportation doesn't make the law but just enforces it, the agency wouldn't say whether it thinks such a fee is contradictory.

The other issue raised by the paper is that the amount collected with such a fee is relatively small. "A drop in the bucket," Dumortier said.

When the bill was passed for the plug-in fees, it was estimated that $213,914 would be collected for HUTF in fiscal year 2014-2015. In the previous fiscal year, the total budget for HUTF was $969.3 million. As of April 2016, there were 3,629 plug-in electric vehicles registered in Colorado.

But if the objective is to fund road repairs, does it matter how much or little is generated?

"If it's truly coming from the perspective of collecting revenue, there are other ways of adjusting fuel taxes to collect significantly more revenue," Dumortier said.

Great, the state's legislators are totally on the same page when it comes to transportation funding.