"Confident” was the buzzword that dominated Chipotle’s quarterly call with investors. Despite the optimism, a new earnings report reveals the Denver-based fast-casual chain still hasn't quite recovered from what company executives have coined “last year’s crisis.”

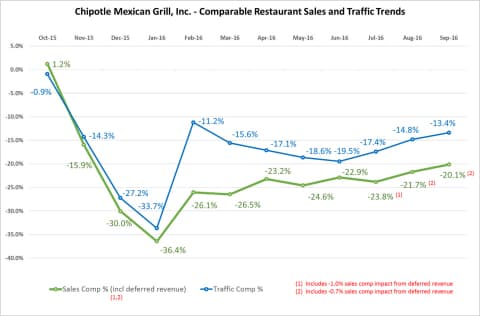

Revenue for the first nine months of the year is down 18.1 percent to $2.9 billion. Restaurant sales were down 21.9 percent.

For the third quarter, revenue across Chipotle’s 2,178 locations decreased 14.8 percent since the previous year — which is actually a slight improvement from the 16.6 percent decrease Chipotle felt from April through June.

Last year, Norovirus, E. coli and Salmonella outbreaks sickened hundreds across the U.S. Chief Marketing Officer Mark Crumpacker was indicted in a cocaine ring bust and several thousand workers sued for wage theft.

Since the “crisis,” Chipotle has been throwing free food at customers and devising creative marketing campaigns, like “A Love Story” and the Chiptopia loyalty program, to win back its long lost baes.

These haven’t quite worked at the pace executives would like. So on a call with investors, Chairman and CEO Steve Ells, CFO Jack Hartung, CEO Monty Moran and the recently returned Crumpacker announced an aggressive plan — a plan one shareholder pointed out seems to be complicating the simplistic Chipotle model.

Topping the agenda is cutting potential costs by about $100 million.

One way to cut costs, Ells explained, is to halt further investment in Chipotle’s Asian-inspired ShopHouse brand.

“We continue to believe in this approach of bringing [different types of] food to people and are confident the right cuisine will work,” Ells said.

He went on to praise ShopHouse’s exotic offerings but said pizza and burgers, i.e. Pizzeria Locale and Tasty Made, would appeal to more consumers.

As far as saving money goes, Crumpacker said as many as 50 high-volume Chipotle restaurants will be remodeled for better lighting, acoustics, seating and customer flow. Executives anticipate these locations will require fewer future repairs, cutting down on operating costs.

A new online system will allow users to cut down on time between online order placement and pick-up. Details of the new system were not disclosed, but Crumpacker said it will supplement existing mobile apps, rather than replace them.

As for in-store tablets, it speaks for itself. Executives said expanded back prep kitchens will allow greater volume of food preparation, so long as customers are willing to step out of line to order and not watch food preparation

Lastly, Chipotle announced it will be ramping up the menu again — this time with dessert.

Ells did not reveal what type of sweets Chipotle would peddle, but mentioned that it would be introduced with much fanfare, similar to the introduction of chorizo, which now makes up 7 percent of sales storewide, to Chipotle's menu.

A stakeholder raised concerns that the new technology, menu additions and the television ad campaign it is currently testing come across as contradictory to Chipotle’s vision of “simple, fresh food.”

“It’s important that when you add something to the restaurant, you take something away,” Ells said. “Not necessarily with menu items, but by removing inefficiencies.”

By inefficiencies, he means extra labor. He went on to say that Chipotle would not not add breakfast items.

“We are beginning to emerge from the most difficult year of our history and are beginning to feel optimistic,” Ells said.

Multimedia business & healthcare reporter Chloe Aiello can be reached via email at [email protected] or twitter.com/chlobo_ilo.

Subscribe to Denverite’s newsletter here.