Alana Romans moved to Denver in 2016 with a bachelor's degree and a sense of idealism. She landed an apartment in Highland and a job at a nonprofit, the Urban Land Conservancy, where she hoped to make a positive impact on the local community through their work developing affordable real estate.

At the end of her first year lease, Romans' landlord notified her that her rent would increase --a lot -- so she decided to move. Romans said she was lucky she had family nearby to support her as she figured out what to do next, but she was still shocked by the price hike. And that's when it hit her: this millennial go-getter was in the same boat as many of the families her employer works to serve.

"I'm a cost-burdened household," she said.

Someone who is "cost-burdened" in this case is someone who pays 30 percent or more of their income on rent.

If you live in Denver right now, there's nearly a fifty-fifty chance that you, too, are cost burdened.

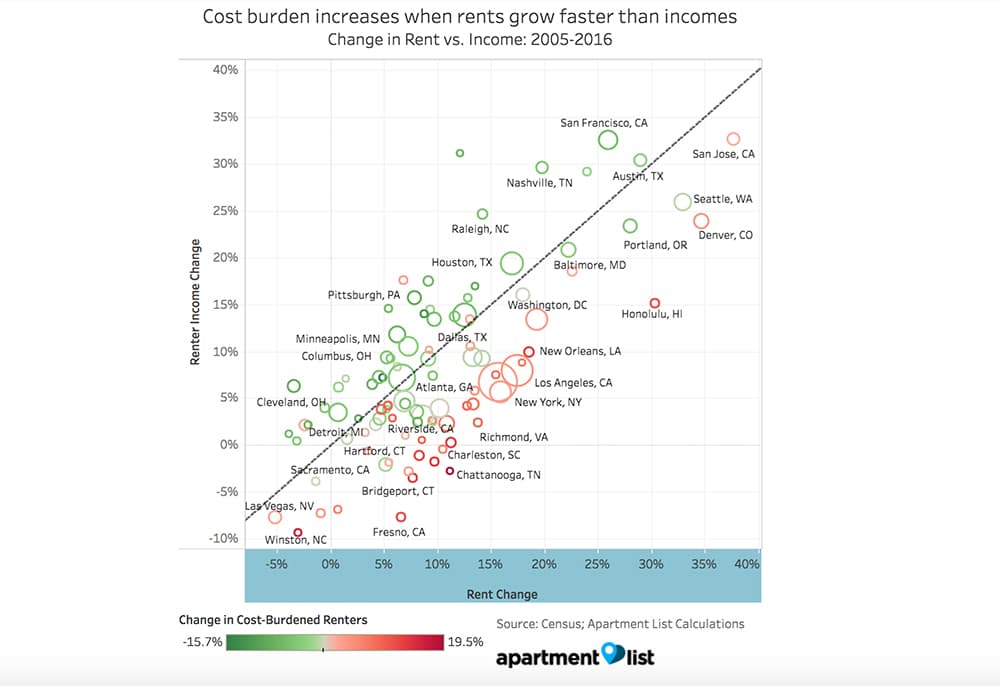

A study out today from Apartment List shows how populations of cost-burdened residents have fluctuated in cities across the nation since the 2008 financial crisis. Many cities now have a smaller proportion of cost-burdened residents, the report says, while Denver is one of only nine cities studied whose residents today are more likely to be cost-burdened than a decade ago.

It's not that cities across the U.S. are becoming more affordable. Instead, cities like San Francisco have seen an influx of high-earners (think: tech industry) that makes their less-wealthy residents a smaller proportion of the overall population.

"Only nine metros of the top 100 metros currently have higher cost burden rates than during the peak of the recession," the report says. "These metros are a mix of metros with struggling economies and those with skyrocketing rents."

Will Kralovec, a board member of All In Denver who also works at the Urban Land Conservancy, said the metrics used in this study are confusing.

The numbers make cities like San Francisco appear to be better off, he said. But many cities, including Denver, have become increasingly difficult for working class families to live in. Whether or not those families represent a growing or shrinking proportion of the population, he stressed, things are still getting harder for them.

It's also swallowing neighborhoods. There once was a greater diversity of price points in Denver, he said. Rents in Capitol Hill, for instance, were once a lot lower than prices downtown. "That spread has narrowed and you can't live anywhere in the city now," he said.

The big difference between a working-class family and someone like Alana Romans is her ability to grow out of her tough financial situation.

"I really want to go places in my career," Romans said. At 26 years old, she sees herself as putting in work that will someday result in financial stability. For cost-burdened parents who are already working multiple jobs, she said, that kind of social mobility might not be possible.