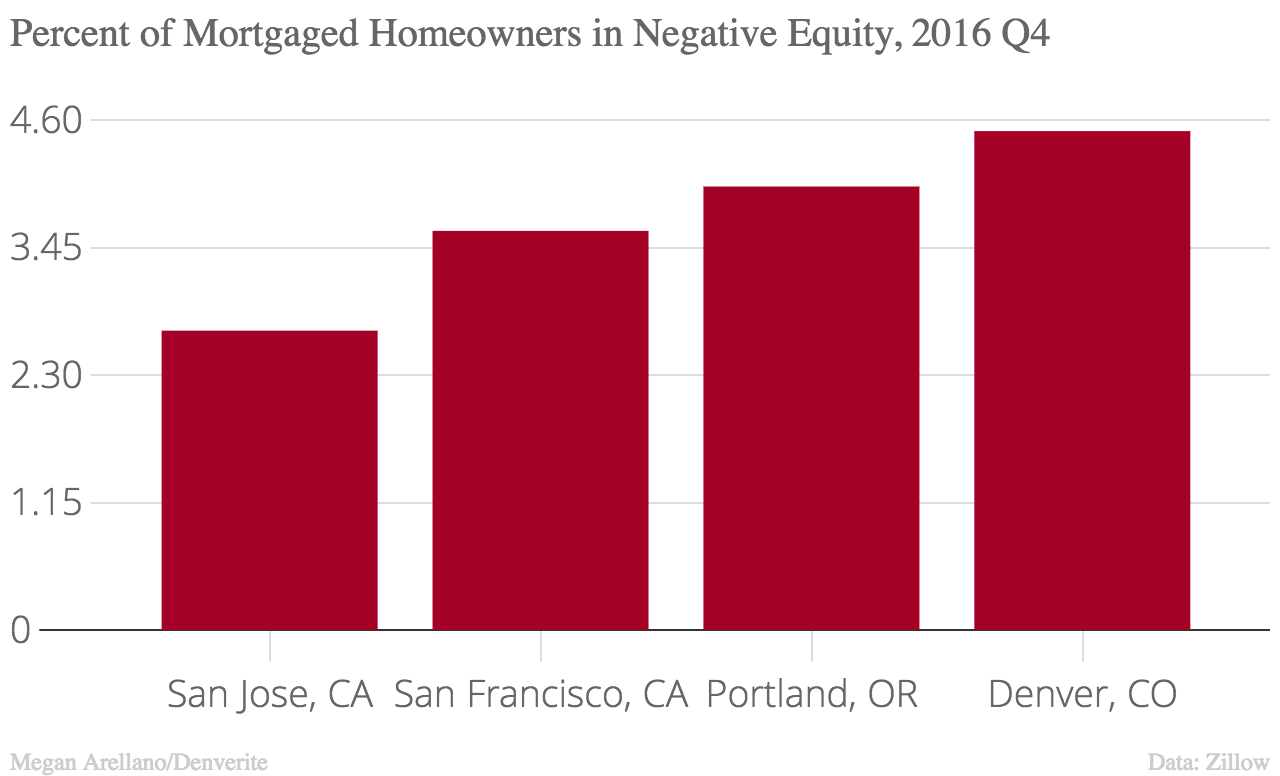

Denver has the fourth lowest rate of negative equity among 36 of the largest U.S. metropolitan areas, according to an analysis from Zillow.

With only 4.5 percent of homeowners owing more than 20 percent of their home's value, the metro is well-below Zillow's national average of 10.5 percent underwater homeowners.

Naturally, this small bit of good news connects to how hot the Denver real estate market is right now. So it should not surprise you that other metropolitan areas with low levels of underwater homeowners are other famously hot real estate areas:

But for those 4.5 percent of homeowners in Denver, the climb back to positive equity is a long one. Zillow's analysis found that only 38.4 percent of homeowners with negative equity were within 20 percent of positive equity.

Even if you don't care for the plight of an individual homeowner, you should care about negative equity if you're thinking of purchasing a house or care about housing affordability.

If a home is underwater, its owners are unable to sell without losing money. That by itself limits the available housing inventory. Plus, given that negative equity tends to disproportionately affect the lower-end housing, that means fewer homes for first-time homebuyers.