STARTUP OF THE WEEK: CAnpay

In this series, we visit Denver-metro, Boulder and Rocky Mountain region startups. Contact [email protected] to be considered.

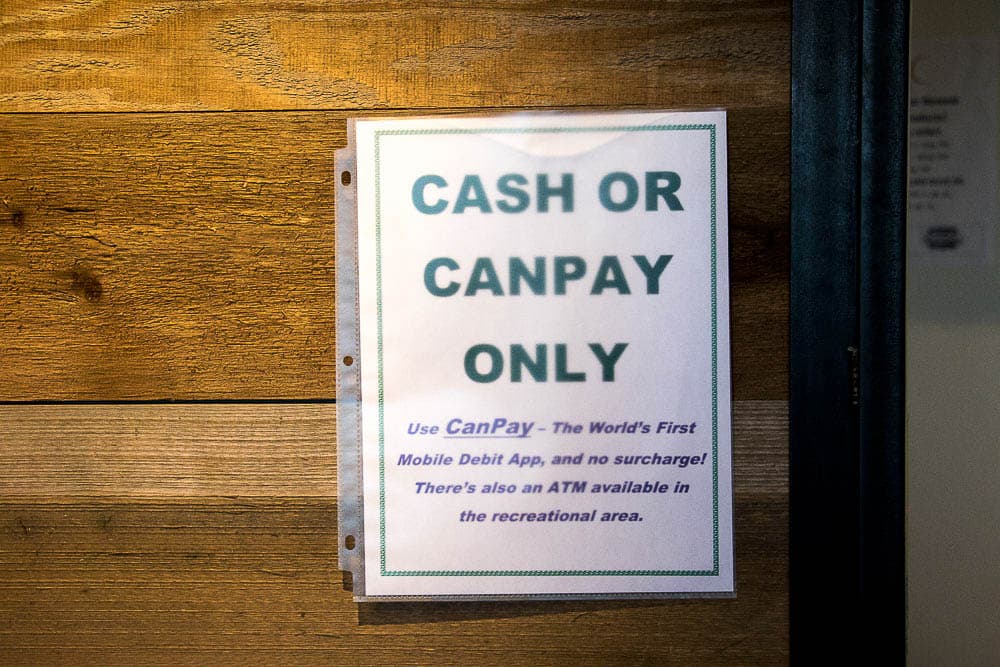

Big innovation is coming to the world of cannabis transactions. Thursday, CanPay launched a new debit payment system that enables users to transfer funds straight from their checking accounts to pay for their dispensary purchases.

Users can download the CanPay app for free, after which point they can link their checking account and begin making payments, just like with a digital wallet.

For dispensaries, fees equate to 1.6 percent plus a 25 cent fee-per-transaction.

"You are looking at a solution that is treating cannabis consumers and cannabis retailers like major card brands treat all other retail businesses," CEO and cofounder Dustin Eide said. "There's no preloading of funds. There's no doing business in someone else's name. This is a solution that allows [cannabis] businesses to operate and act as any other retailer."

CanPay is one of many payment solutions that has emerged as an answer to the financial challenges businesses in the cannabis industry still face after legalization. Due to federal regulations, credit card companies cannot take the risks associated with marijuana businesses. And many cannabis businesses still struggle to find banks that will work with them.

This leaves dispensaries handling large sums of cash and sometimes jumping between bank accounts, which can be complicated and risky.

But unlike Tokken, which launched a blockchain cannabis banking app in October, CanPay does not seek to help businesses comply with industry standards.

"Others are trying to accomplish compliance with federal laws," Eide said. "We are working with banks and credit unions, and we only work with retailers that have compliant bank accounts with those institutions."

So retailers have to have worked out their banking issues to take CanPay. However, customers don't need to bank with any particular institution to use it.

CanPay is based on established relationships with local banks and credit unions. In Colorado, the primary partner is Safe Harbor Private Banking, a division of Partner Colorado Credit Union. All CanPay does is enable consumers to skip the credit card and transfer funds directly from their bank account to the bank account of a dispensary at a partner institution.

In fact, Eide believes the whole notion that legitimate banking does not exist in the cannabis industry is a misconception.

"The theme is that banking does not exist in the cannabis industry where there is robust regulation," Eide said. "That is not true for everyone, there are multiple options in many of the states including Oregon, Colorado and Washington."

Eide said that beyond Safe Harbour, CanPay has already established relationships with banks and credit unions in Washington and Oregon, though he could not say which.

CanPay launched a pilot version of the app at Colorado Harvest dispensary's Kalamath location in June. Now, three of Colorado Harvest's locations use CanPay.

Nick Anderson, store manager at the South Broadway location, said CanPay eliminates some of the challenges that a cash-only system poses at the point of sale.

"It can affect the size of the sale," he said. "People try to do the math in their heads on the way here. A lot of times they swing by their bank so they don't have to pay the fees and then it limits what they can buy."

He said the customers who use it find it easy, but it is sometimes difficult to get customers to sign up. The largest demographic of users are regulars at the dispensary.

As for CanPay, they hope to help cannabis retailers legitimize the payment aspect of their business -- after they find compliant banking.

By the time Visa and Mastercard do enter the industry, CanPay hopes its network will be large enough that it will exist as a low-cost competitor to more standardized payment methods.

Founder: Dustin Eide

Employees: 2

Industry: Banking, cannatech

Launched: Nov. 17, 2016

Funding: Self-funded

Offices: Littleton, Colorado

Multimedia business & healthcare reporter Chloe Aiello can be reached via email at [email protected] or twitter.com/chlobo_ilo.

Subscribe to Denverite’s newsletter here.